AI-Powered vCIP:

Smarter, Faster & Compliant Customer Onboarding

Seamless Video-Based KYC with Advanced AI for Secure, Compliant, and Hassle-Free Identity Verification.

Deployed in 15 Countries Globally

AI-Powered vCIP:

Smarter, Faster & Compliant Customer Onboarding

Toucan’s vCIP (Video-Based Customer Identification Process) is an RBI-compliant, AI powered video KYC solution that enables businesses to authenticate, onboard, and verify customers' securely over live video.

vCIP Verification: Secure, Compliant & Hassle-Free

Toucan’s vCIP ensures seamless remote identity verification while meeting global KYC compliance standards.

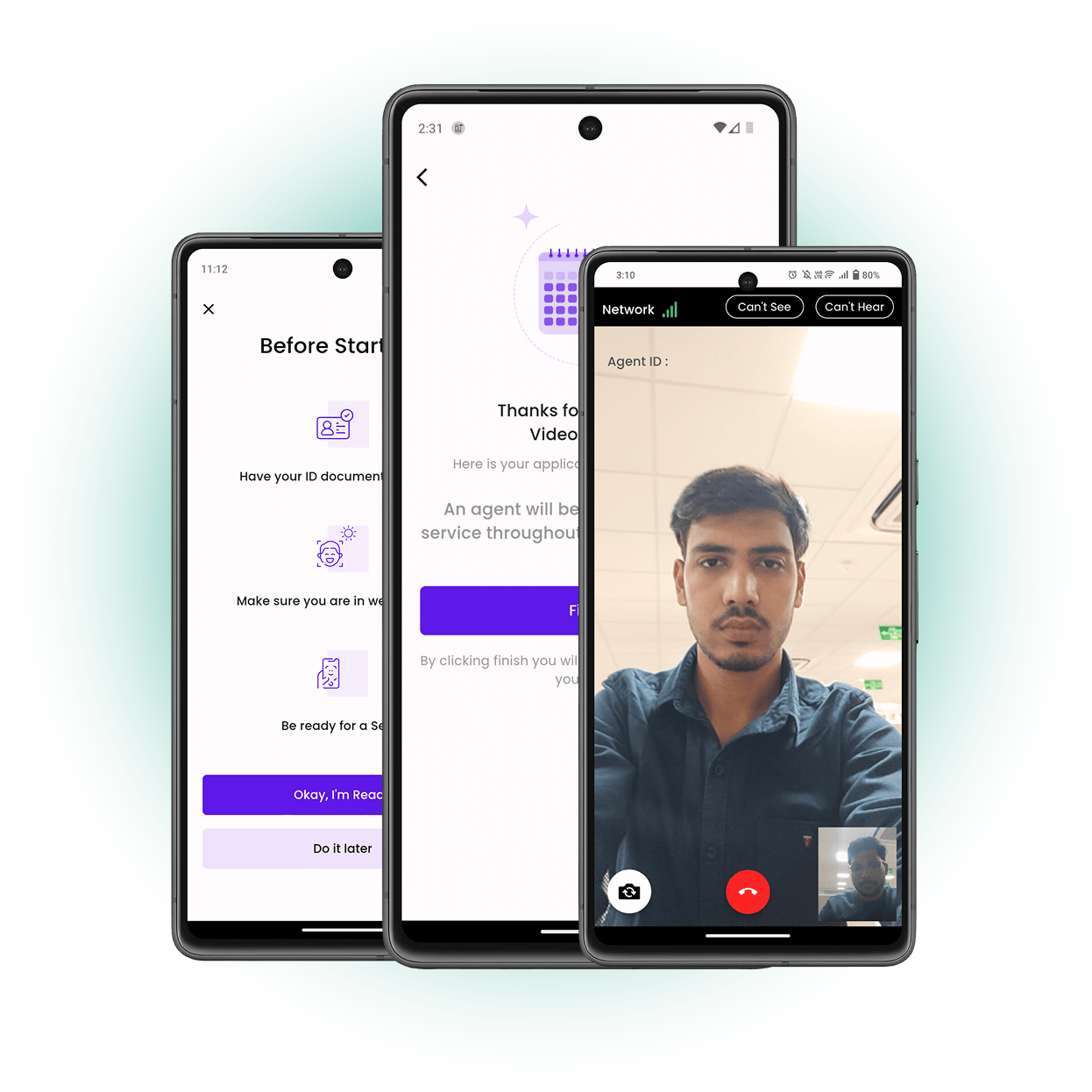

How It Works – A Step-by-Step Process

01.

Pre-Call Authentication

- OTP-Based Login – Customers receive a one-time password (OTP) via SMS/email for initial authentication

- Government ID Verification – AI-driven Aadhaar & PAN validation ensures document authenticity

- Auto-Filled Personal Details – System pre-populates data for seamless entry, reducing errors

02.

During the Call –AI-Powered Identity Checks

- AI-driven face detection & liveness verification (blink, speech, and movement tracking)

- Real-time document scanning with OCR for ID verification

- AI-powered facial matching against submitted documents

03.

Post-Call – Secure Compliance & Approval

- Automated video recording & audit-ready logs for regulatory compliance

- KYC officer review & approval process with instant notifications to users

- Real-time status tracking via SMS, email, or app notifications

Key Features of Toucan’s vCIP Solution

AI-Powered Facial & Document Verification

Secure authentication using deep learning models

Geo-Tagging for Compliance

Verify user location with GPS coordinates

Real-Time Fraud Detection

AI-driven identity protection & anomaly detection

Automated Approvals & Decisioning

Reduce manual interventions with intelligent workflow automation

Omni-Platform Support

Accessible via web, mobile, and API integrations

Why Choose Toucan's vCIP?

AI-Driven Security & Fraud Prevention

Detect spoofing, deepfakes & identity fraud with machine learning

Regulatory Compliance Made Easy

100% RBI-compliant, ensuring AML & KYC adherence

Fast, Hassle-Free Onboarding

Reduce manual verification & onboard customers in seconds

Cost Efficiency

Reduce operational overhead with automated verification

Enterprise-Grade Protection

Encrypted video calls, secure WebSocket communication & GDPR-compliant data handling

Customizable Workflows

Tailor KYC flows for banks, NBFCs, FinTech's, and digital wallets

No branch visits, no paperwork

Just seamless verification anytime, anywhere!

Get Started with Toucan vCIP

Frequently Asked Questions

vCIP (Video-based Customer Identification Process) is an AI-powered digital KYC method that enables remote identity verification via secure video calls.

Yes! Our vCIP solution is fully compatible with Android & iOS, ensuring smooth onboarding across platforms.

We use bank-grade encryption, AI-driven fraud detection, and regulatory compliance measures to ensure customer security.

Our AI-powered vCIP technology enhances accuracy by using facial recognition, liveness detection, and document verification to minimize errors and fraud risks.

We accept government-issued IDs such as passports, national ID cards, and driver’s licenses. Ensure the document is clear, valid, and up to date for a smooth verification process.

With Toucan’s AI automation, verification takes less than 5 minutes, subject to document quality & compliance approvals.

If you face any issues, try restarting your app or checking your internet connection. If problems persist, our customer support team is available 24/7 to assist you.

Yes, VCIP is designed to comply with relevant regulatory standards and requirements, including those related to customer identification and data privacy.

Pricing varies based on usage. Contact our sales team for a tailored plan that fits your business.

Toucan’s vCIP simplifies remote customer verification with secure video-based authentication. Powered by AI-driven fraud detection, facial recognition, and digital ID verification, it reduces onboarding costs, enhances security, and ensures full KYC compliance. Plus, with end-to-end encryption, your customers’ data remains private and never stored—ensuring a seamless yet secure experience.

Follow these quick steps to get verified hassle-free:

1. Get Ready

Reduce failed transactions with intelligent payment routing. If a payment fails, our system automatically retries via a better route, minimizing drop-offs & lost sales.

2. Schedule Your V-CIP Call

Not ready yet? No problem. Pick a convenient time slot and receive a confirmation via push notification or SMS. Join the call as scheduled and proceed with verification.

3. Start Your Video KYC Call

Click “Okay, I am ready” to start your secure video KYC instantly. Share your live location, upload ID images, provide a live selfie for identity matching, and complete a liveness check by reading an OTP on-screen.

4. AI-Powered Identity Verification

Once you submit your documents and selfie, our AI-driven system instantly extracts key details, verifies them with trusted databases, matches your selfie with your ID using facial recognition, confirms authenticity via geo-tagging, and prevents fraud with advanced video forensics.

5. Quick Onboarding & Approval

After successful verification, your application moves to the audit phase for final approval. You will receive a confirmation once your KYC is complete, allowing you to access services instantly.

6. Track Your Application Status

As a part of application tracking, you will receive real-time status updates via SMS and email, keeping you informed on whether your application is approved, pending review, or rejected.