Digital Wallets: The Future Beyond Just Payments

Imagine a world where your wallet isn’t stuffed with cash, cards, or IDs—because everything you need is securely stored on your phone. That world isn’t in the distant future; it’s happening now. Digital wallets have evolved from simple payment tools to comprehensive financial and identity management platforms.

Whether it’s Gen Z ditching physical wallets altogether or businesses embracing mobile-first transactions, the global shift towards digital wallets is undeniable. But what’s driving this transformation? And how are digital wallets shaping the future of money, security, and identity? Let’s dive in.

Global Trends in Digital Wallet Adoption

Digital wallets have transformed the way people pay, bridging the gap between convenience and security. With smartphone penetration skyrocketing and contactless payments becoming the norm, digital wallets are seeing widespread adoption across the globe.

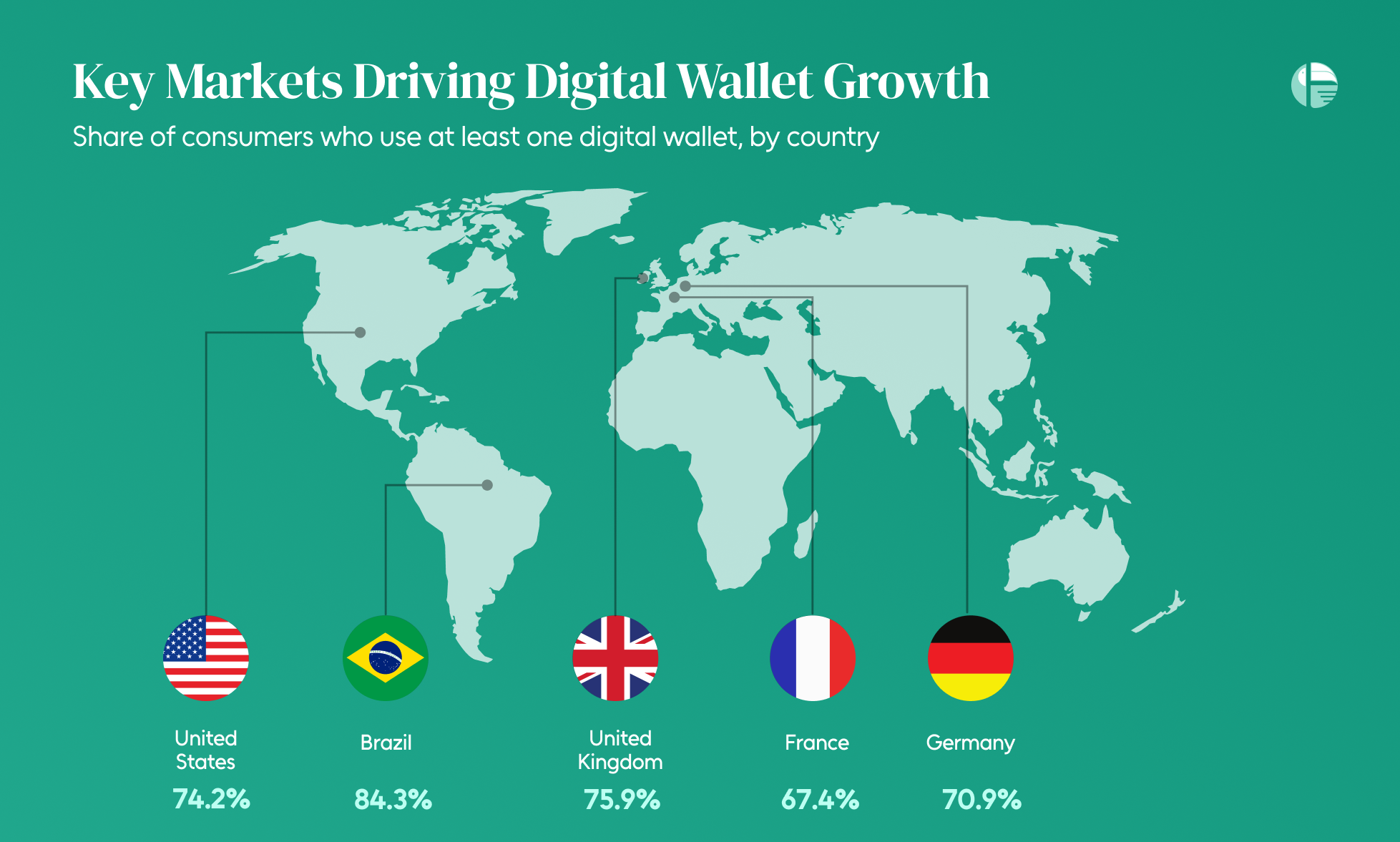

Key Markets Driving Digital Wallet Growth

- United States Digital wallet usage

While credit cards remain dominant, digital wallet adoption in the U.S. is steadily increasing. Major players like Apple Pay, Google Pay, and PayPal are leading the charge, especially among younger consumers.

- Digital Wallets in Europe

European nations, including the UK, France, and Germany, are witnessing rapid digital wallet adoption. Regulatory support, such as PSD2, has fueled the growth of mobile payments and open banking, making wallets more seamless and secure.

- Asia-Pacific: The Epicenter of Digital Payments

China and India are at the forefront, with platforms like Alipay, WeChat Pay, and PhonePe revolutionizing the market. QR code-based payments, government-backed initiatives, and financial inclusion efforts are propelling digital wallet usage.

- Digital Wallet Surge in Latin America

Countries like Brazil are witnessing a surge in digital wallet usage, driven by fintech innovations and central bank-led initiatives like Pix, which has made instant payments more accessible.

- Brazil Takes the Lead in Digital Wallet Usage

Brazil has emerged as the global frontrunner in digital wallet adoption, with 85% of consumers storing information in at least one digital wallet. This trend underscores the growing reliance on digital payment solutions and secure credential storage. The U.S. follows closely behind, with 74% of consumers using digital wallets for similar purposes.

Why Digital Wallets are gaining popularity in Gen z

Gen Z is redefining the way we interact with money, and digital wallets are at the center of this transformation. Unlike previous generations, Gen Z consumers are digital natives who expect seamless, instant, and secure financial transactions.

With their strong preference for convenience and technology-driven solutions, it’s no surprise that digital wallets are becoming their go-to financial tool.

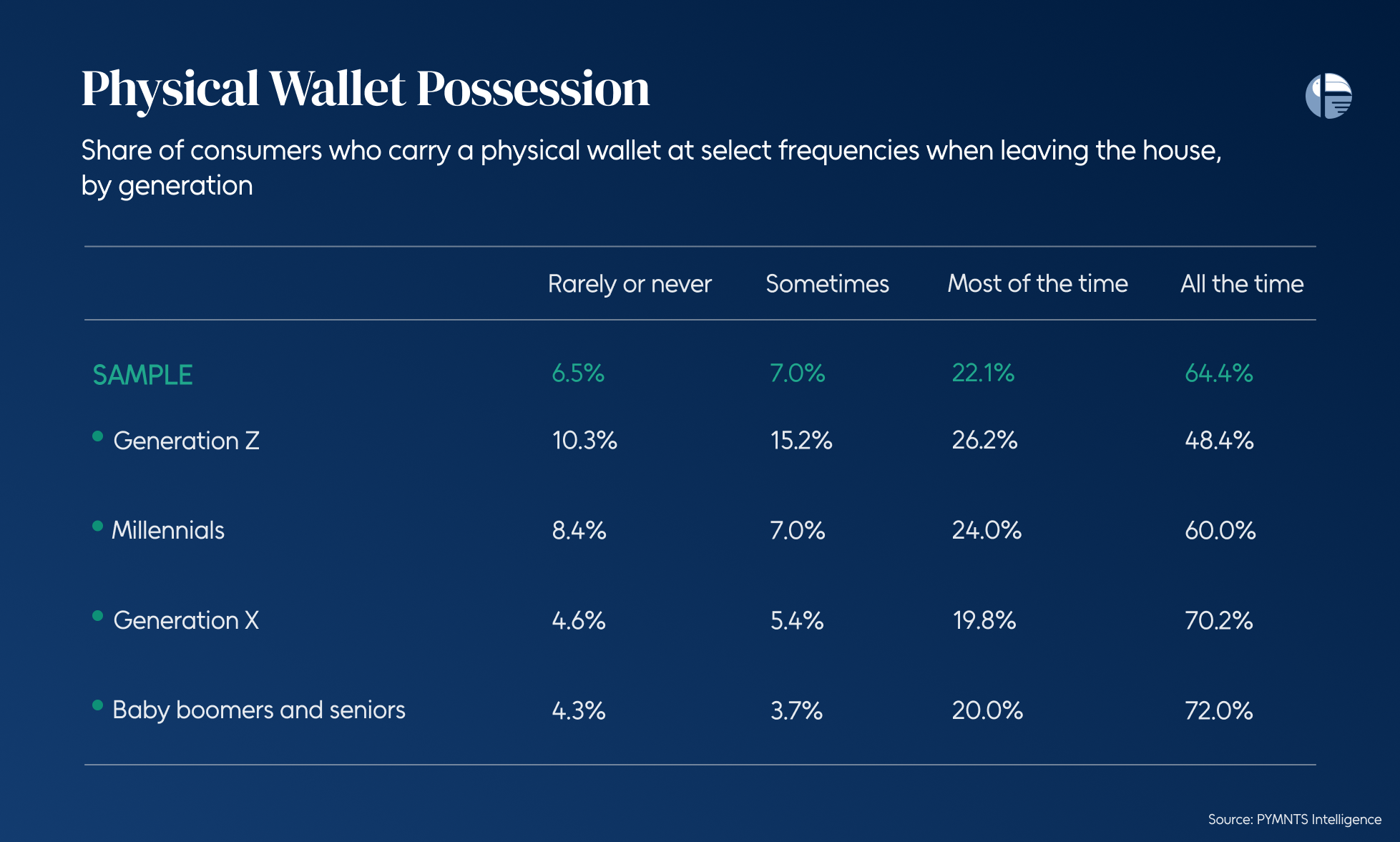

A Shift Away from Physical Wallets

The days of carrying bulky wallets filled with cash, cards, and IDs are numbered—at least for Gen Z. Research shows that 1 in 10 Gen Z consumers never carry a physical wallet, and nearly half (48%) say they always carry a wallet when leaving home, compared to 74% of skeptics who still rely on traditional wallets.

This generational shift indicates that digital wallets are quickly replacing physical wallets as the preferred method of financial management and identity verification.

More Than Just Payments

While digital wallets were initially designed for payments, Gen Z is using them for much more. 27% of Gen Z consumers have stored both payment and access credentials in their digital wallets in the past year, compared to just 17% of Gen X.

From ID verification to accessing events, boarding flights, and even storing vaccination records, Gen Z leverages digital wallets as an all-in-one tool for secure digital access.

Security & Convenience Drive Adoption

Security is a top concern for Gen Z, and digital wallets provide encrypted, biometric-protected storage for financial and personal data. Countries like Brazil, where concerns over identity theft are high, see digital wallets as a way to reduce the risk of losing identity documents.

What are the Digital wallet user personas?

For decades, the physical wallet has been a staple of everyday life, carrying everything from cash and cards to IDs and membership passes.

But as digital transformation accelerates, digital wallets are emerging as the next frontier in identity management—offering seamless storage and use of digital credentials. While adoption is growing, the journey from physical to digital is not uniform across consumers:

1. Pioneers: Leading the Charge

Pioneers are the early adopters—consumers who actively use digitally stored credentials for access and verification. Whether it’s scanning a mobile boarding pass at the airport, using a digital ID for secure entry, or redeeming loyalty rewards, pioneers see the full potential of digital wallets.

2. Prospects: The Hesitant Adopters

Prospects have already stored their credentials in digital wallets but haven’t used them for access or verification yet. They recognize the value but remain cautious, possibly due to security concerns or a lack of widespread acceptance in certain scenarios. Their hesitation represents a major opportunity for digital wallet providers to build trust through enhanced security measures and broader usability.

3. Explorers: The Curious but Cautious

Explorers have yet to store credentials in digital wallets but are interested in doing so. This segment includes tech-savvy consumers intrigued by convenience but still weighing the risks. As digital wallets continue to prove their security and efficiency, explorers are likely to transition into active users, particularly for essential use cases like travel, digital ID verification, and event access.

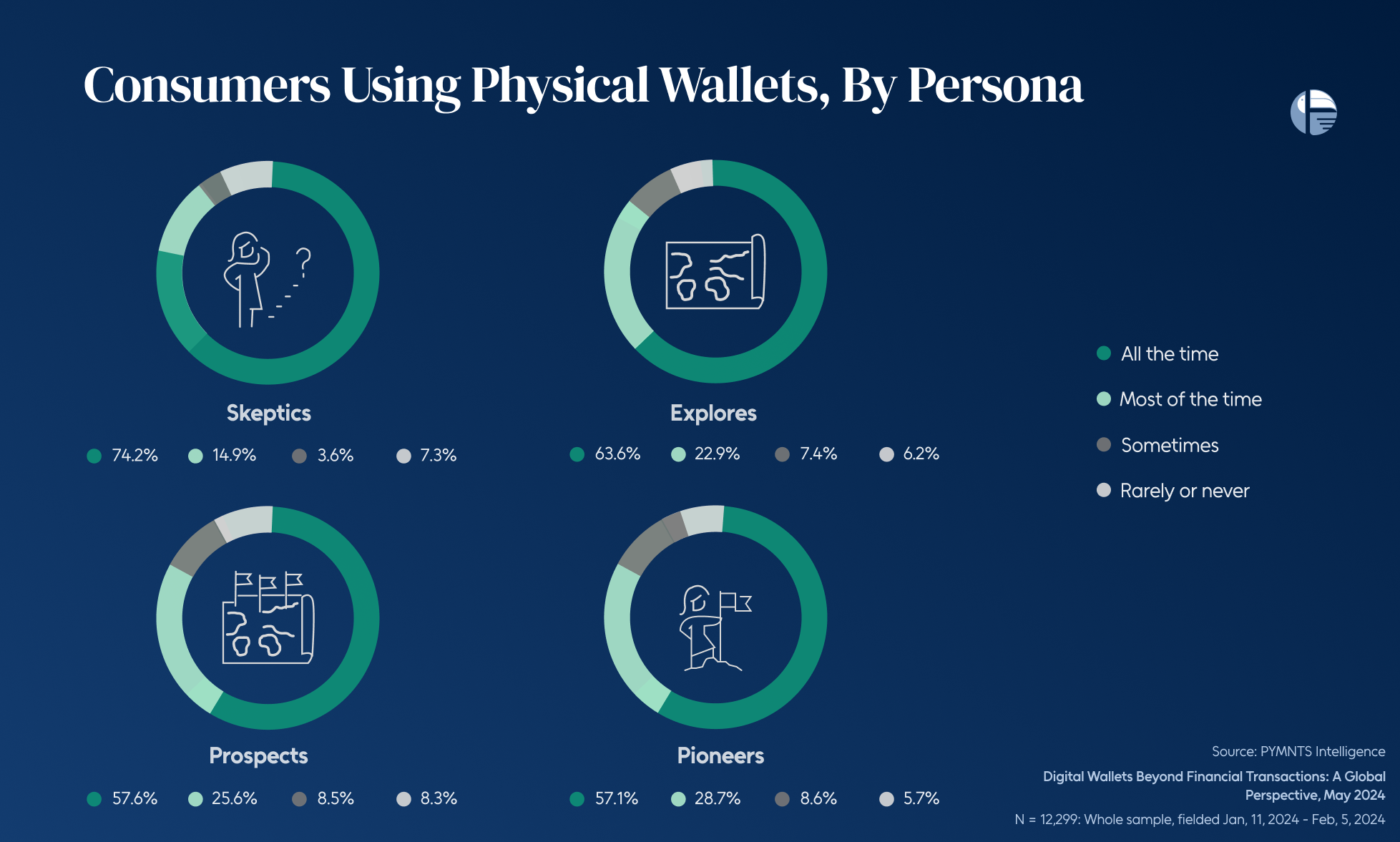

4. Skeptics: Sticking to the Physical Wallet

Skeptics are the most resistant, with no interest in storing or using digital credentials. A significant 74% of them still carry a physical wallet at all times, highlighting their preference for traditional methods. Many skeptics cite security and privacy concerns as primary barriers, reinforcing the need for stronger education on encryption and fraud protection.

Who’s Storing Digital Credentials—and Who’s Not?

A closer look at consumer behavior reveals four key personas shaping the future of digital credential storage:

- Skeptics (74% carry a physical wallet at all times) – Resistant to digital alternatives, these consumers rely on traditional wallets for identification and transactions.

- Explorers (63.6% carry a physical wallet always) – Interested in digital wallets but have yet to transition fully, they are testing digital storage cautiously.

- Prospects (57.6% always carry a physical wallet) – Have stored digital credentials but are not actively using them for access or verification.

- Pioneers (57.1% always carry a physical wallet) – These early adopters actively use digital credentials for tasks like boarding flights and accessing loyalty rewards.

Interestingly, even among pioneers, over half still carry a physical wallet, showing that while digital credentials offer convenience, they have not yet entirely replaced traditional methods.

The Future is Digital—Are You Ready?

Digital wallets are no longer just a convenience; they are becoming a necessity in our increasingly digital world. From secure payments and ID verification to travel and event access, their use cases are expanding rapidly. While adoption varies by region and user persona, one thing is clear: the transition from physical to digital is accelerating.

As businesses and consumers continue to embrace this shift, those who adapt early will reap the benefits of a more seamless, secure, and connected financial ecosystem. So, the question isn’t whether digital wallets will replace physical ones—it’s how soon.