Why Legacy Payment Systems Can’t Keep Up with Modern Business Needs

Legacy payment systems weren’t built for today’s digital-first world, leading to high failure rates, limited global reach, and lost revenue. Customers expect seamless transactions, yet legacy systems struggle to keep up with new payment methods, smart routing, and fraud prevention.

Enter payment orchestration—the game-changer that fixes these inefficiencies. By integrating multiple payment service providers, optimizing transaction flows, and automating fraud detection, payment orchestration platforms unlock higher approval rates, lower costs, and a superior customer experience. In this blog, we’ll break down how payment orchestration bridges the gap between legacy failures and the future of seamless, scalable payments.

How Payment Orchestration Platforms Fix Legacy System Failures

The world of payments is no longer just a backend necessity—it’s now a strategic growth engine. Businesses that once viewed payments as a cost center are realizing that seamless, efficient transactions directly impact customer acquisition, retention, and revenue. Yet, many companies are struggling to adapt because their legacy payment systems are holding them back.

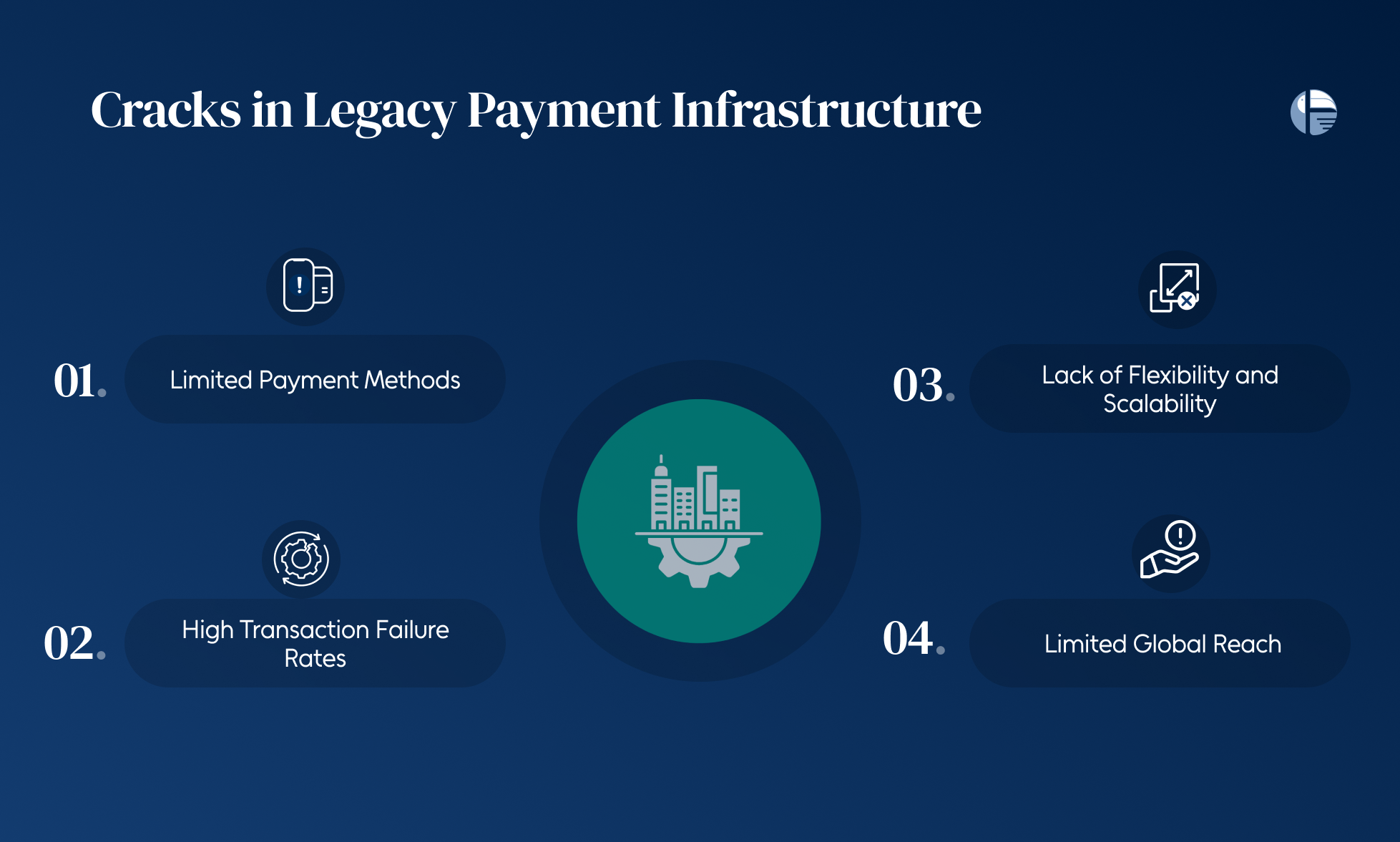

The Cracks in Legacy Payment Infrastructure:

- Limited Payment Methods – Traditional payment infrastructures struggle to support new payment options such as digital wallets, BNPL (Buy Now, Pay Later), and cryptocurrencies, leading to customer drop-offs.

- High Transaction Failure Rates – Legacy systems often have rigid routing mechanisms, causing unnecessary declines and lost revenue.

- Lack of Flexibility and Scalability – Businesses expanding into new markets must integrate multiple payment gateways, which legacy systems fail to support efficiently.

- Limited Global Reach: Expanding into new markets becomes a challenge as legacy systems struggle with local payment preferences and regulatory requirements.

How Payment Orchestration Bridges the Gap

Payment orchestration platforms (POPs) are emerging as the ultimate solution to these legacy failures. Designed to streamline the entire payment ecosystem, these platforms integrate multiple payment service providers, acquirers, and fraud prevention tools into a single, unified system.

Key Benefits of Payment Orchestration:

Smart Routing for Higher Conversions Payment orchestration platforms intelligently route transactions through the most cost-effective and efficient payment rails, increasing approval rates and reducing declines. Businesses can dynamically switch between acquirers to optimize performance.

Multi-Provider Integration Unlike legacy systems that rely on rigid, single-provider setups, orchestration platforms allow businesses to plug into multiple PSPs (Payment Service Providers). This ensures redundancy, minimizes downtime, and provides customers with diverse payment options.

Fraud Prevention Without Friction Advanced orchestration platforms use AI-driven fraud detection, balancing security with user experience. By leveraging machine learning, these platforms can distinguish genuine transactions from fraudulent ones in real time—reducing false declines and minimizing chargebacks.

Global Expansion Without Headaches Expanding internationally requires compliance with different regulatory frameworks and accommodating diverse payment preferences. Orchestration platforms simplify this by offering localized payment methods, currency conversions, and built-in regulatory compliance tools.

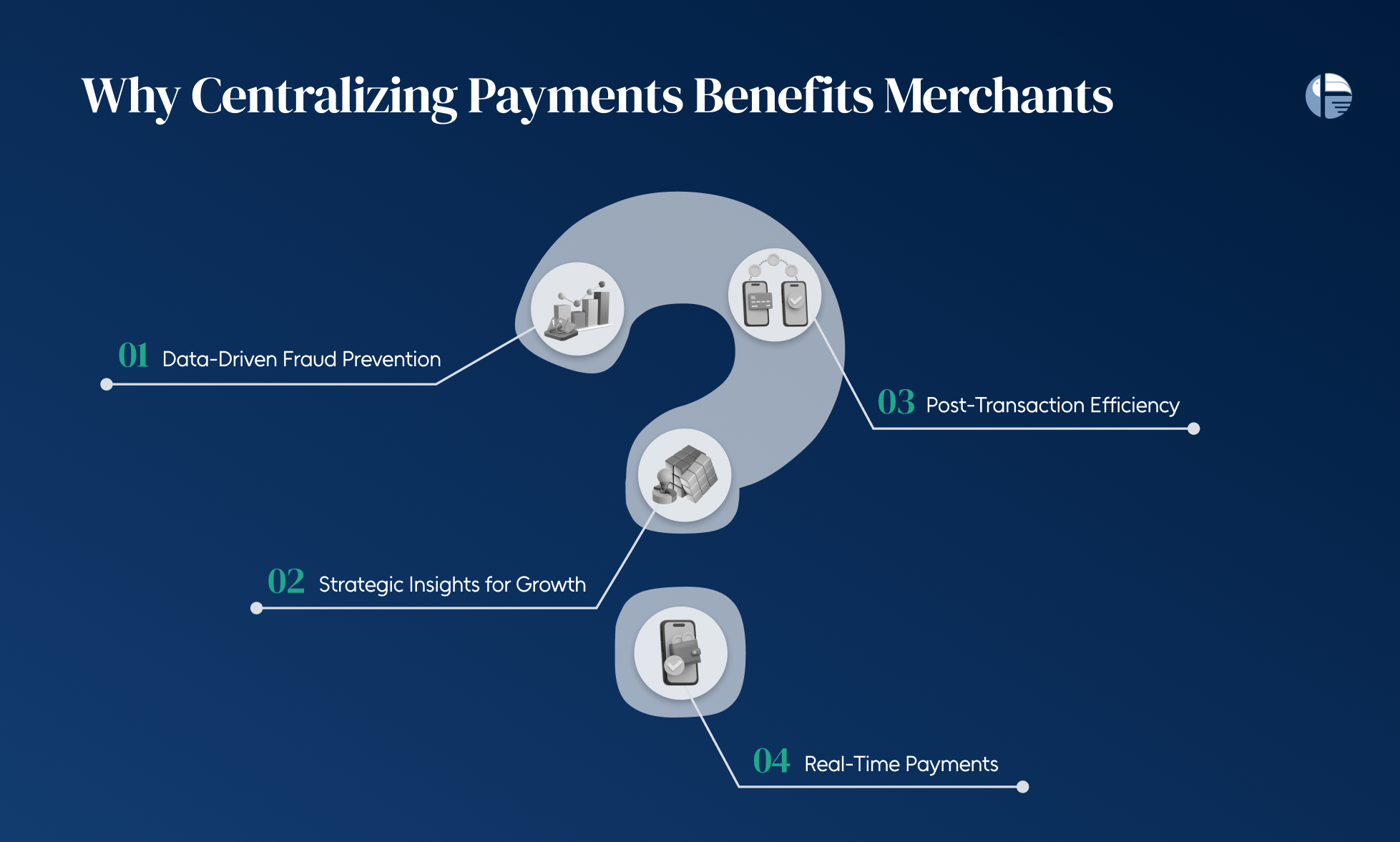

Why Centralizing Payments and Fraud Management Benefits Merchants

Legacy payment systems often force merchants to juggle multiple acquirers, processors, and fraud prevention tools. This fragmented approach not only complicates operations but also increases costs, delays transactions, and weakens fraud defenses. In an era where digital payments dominate, businesses need a streamlined strategy to optimize success rates and protect revenue.

By centralizing payments and fraud management under a single platform, merchants gain control, transparency, and efficiency. Payment orchestration enables automatic acquirer selection, ensuring transactions are routed to the most effective processor based on success rates, transaction type, and geography. If an acquirer declines a transaction, the system can reroute it instantly, minimizing lost sales.

Data-Driven Fraud Prevention

Fraud prevention must be proactive, not reactive. A centralized system integrates AI-driven risk analysis, leveraging real-time data to detect suspicious patterns before fraud occurs. Merchants can customize risk parameters, reducing false declines and ensuring genuine transactions go through smoothly. Unlike siloed fraud solutions, an all-in-one approach provides a comprehensive view of threats across all payment channels.

Strategic Insights for Growth

With a unified payments and fraud system, merchants gain access to critical data insights. They can track approval rates by acquirer, pinpoint peak transaction periods, and optimize pricing strategies. Real-time dashboards offer a “single pane of glass” view, allowing businesses to make informed decisions that enhance customer experience and boost revenue.

Post-Transaction Efficiency

Payments don’t end when a transaction is approved. Merchants need seamless reconciliation, chargeback management, and partner payouts. A centralized platform automates these processes, reducing revenue leakage and freeing finance teams to focus on growth strategies rather than manual reconciliation

Real-Time Payments and Faster Settlements

Centralization also opens the door to real-time payments (RTP), where funds settle instantly, improving cash flow and eliminating chargeback risks. With RTP, merchants bypass interchange fees and reduce reliance on card networks, leading to significant cost savings.

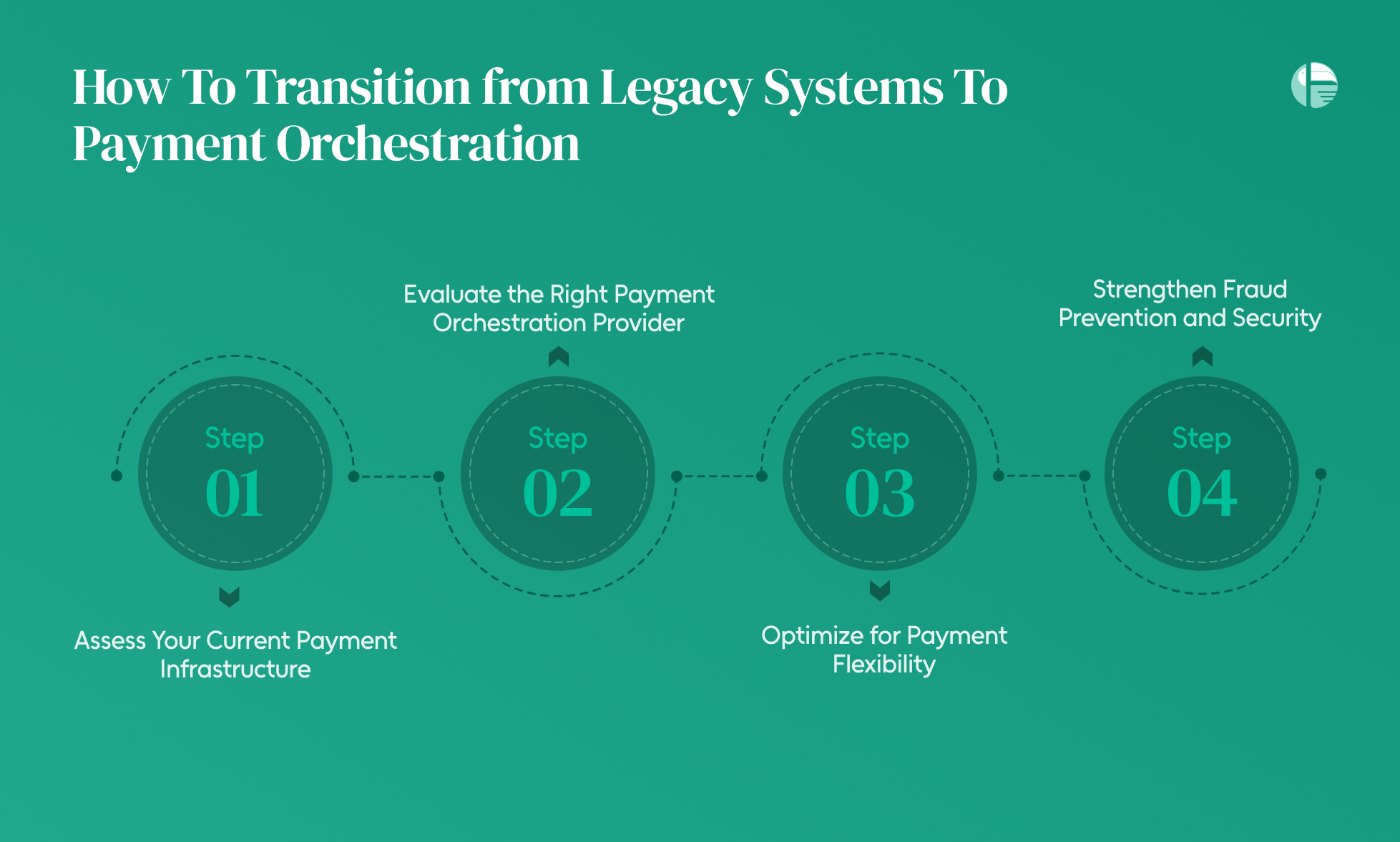

How To Transition from Legacy Systems To Payment Orchestration

The digital economy demands seamless, efficient, and secure payment experiences. Yet, many businesses are stuck with legacy payment systems that are rigid, expensive, and ill-equipped to handle the complexities of modern transactions.

Payment orchestration is the key to overcoming these limitations—offering businesses enhanced flexibility, cost efficiency, and fraud prevention. But how can companies make the shift without disrupting operations? Here’s a structured roadmap to transition smoothly from legacy systems to payment orchestration.

- Assess Your Current Payment Infrastructure

Before making any changes, businesses must conduct a comprehensive audit of their existing payment setup. Identify key limitations—whether it’s high transaction fees, limited payment methods, compliance gaps, or poor fraud prevention. Understanding these weaknesses will help you determine what features to prioritize in a payment orchestration platform.

- Evaluate the Right Payment Orchestration Provider

Not all payment orchestration platforms are created equal. Businesses should assess providers based on:

- Integration Simplicity: A robust orchestration platform should integrate as seamlessly as a single gateway or acquirer.

- Pricing Model Transparency: Look beyond just transaction fees—consider hidden costs like onboarding, monthly maintenance, and API usage fees.

- Optimize for Payment Flexibility

One of the key advantages of payment orchestration is the ability to dynamically route transactions through multiple payment gateways, ensuring optimal success rates and lower fees. Businesses should leverage this flexibility to:

- Add new payment methods to cater to evolving customer preferences.

- Remove underperforming payment options that increase friction.

- Strengthen Fraud Prevention and Security

Legacy systems often rely on outdated fraud prevention tools, leading to higher chargebacks and false declines. Payment orchestration enables merchants to integrate advanced fraud detection mechanisms, including:

- AI-powered risk scoring and machine learning models.

- Real-time transaction monitoring.