How Can Merchant Acquirers Achieve Long-Term Success?

In today’s hyper-competitive digital landscape, businesses face immense pressure to deliver seamless customer experiences. Merchant Acquirers, in particular, must adapt swiftly to changing trends and customer expectations to stay relevant.

From embracing the one-stop solution approach to simplifying product propositions, navigating pay-by-bank disruptions, and delivering frictionless experiences, the journey from early trials to mass rollout is a delicate balance of strategy, innovation, and execution. This blog unpacks 6 focus points to help acquirers drive value, cut costs, and gain a competitive edge.

The One-Stop Solution Approach: How Merchant Acquirers Can Drive Value

The transition from being a payment processor to a full-service merchant solution provider is more than a trend; it’s a necessity. According to a 2022 McKinsey survey, small businesses in the U.S. are willing to spend up to $10,000 annually on value-added services. This data highlights a clear willingness to invest in tools that drive efficiency, customer retention, and growth.

Key Elements of a One-Stop Solution

To truly drive value, acquirers must offer a comprehensive suite of services that address diverse merchant needs:

Integrated Payments: Ensure seamless, omnichannel payment acceptance with robust fraud prevention and advanced routing capabilities.

Data-Driven Insights: Provide merchants with analytics tools that offer actionable insights into customer behavior, sales trends, and operational efficiency.

Value-Added Services: Expand beyond payments to offer solutions such as:

- Loyalty Programs: Help merchants retain customers and boost sales.

- Marketing Tools: Empower merchants to launch targeted campaigns.

- Payroll and Financing Solutions: Simplify back-office operations and support financial growth.

Customizable Options: Tailor offerings to meet specific industry demands, from retail to hospitality to e-commerce.

Simplifying Product Propositions: Key to Cutting Costs and Boosting Sales

Merchant acquirers today face a critical challenge: complexity. Years of mergers, acquisitions, and fragmented growth have created an array of overlapping solutions that confuse merchants and drain operational efficiency. For acquirers, the opportunity to simplify product propositions has never been more urgent (or rewarding as well) and here is how they can outpace the urgency:

- Declutter with a Clear Product Strategy

Merchants want simplicity, not complexity. A tangled web of solutions only frustrates customers and slows down decision-making. Merchant acquirers must develop a clear product strategy that simplifies their market-facing propositions. The goal is to make it easier for merchants—and your sales teams—to understand, adopt, and sell your solutions. A simplified strategy builds trust, improves communication, and accelerates sales. - Invest in Platform Rationalization

Multiple payment gateways and redundant platforms often result from years of M&A activity. Instead of operating these disparate systems, acquirers should focus on consolidating and streamlining their platforms. Retiring outdated systems and adopting a unified payment orchestration layer can revolutionize operations. - Boost Sales with Simplified Integration

Streamlined product propositions don’t just benefit merchants—they empower sales teams. Unified platforms and simplified solutions mean less time spent explaining complex systems and more time closing deals. Integration of multi-acquiring options and new services becomes frictionless, enabling your team to sell confidently and efficiently. - Focus on Merchant Experience

Merchants are at the heart of the payments ecosystem. By simplifying product offerings, pricing models, and integration processes, acquirers can offer a seamless and satisfying experience. This simplification builds loyalty, enhances customer satisfaction, and ensures that your solutions stand out in a crowded marketplace.

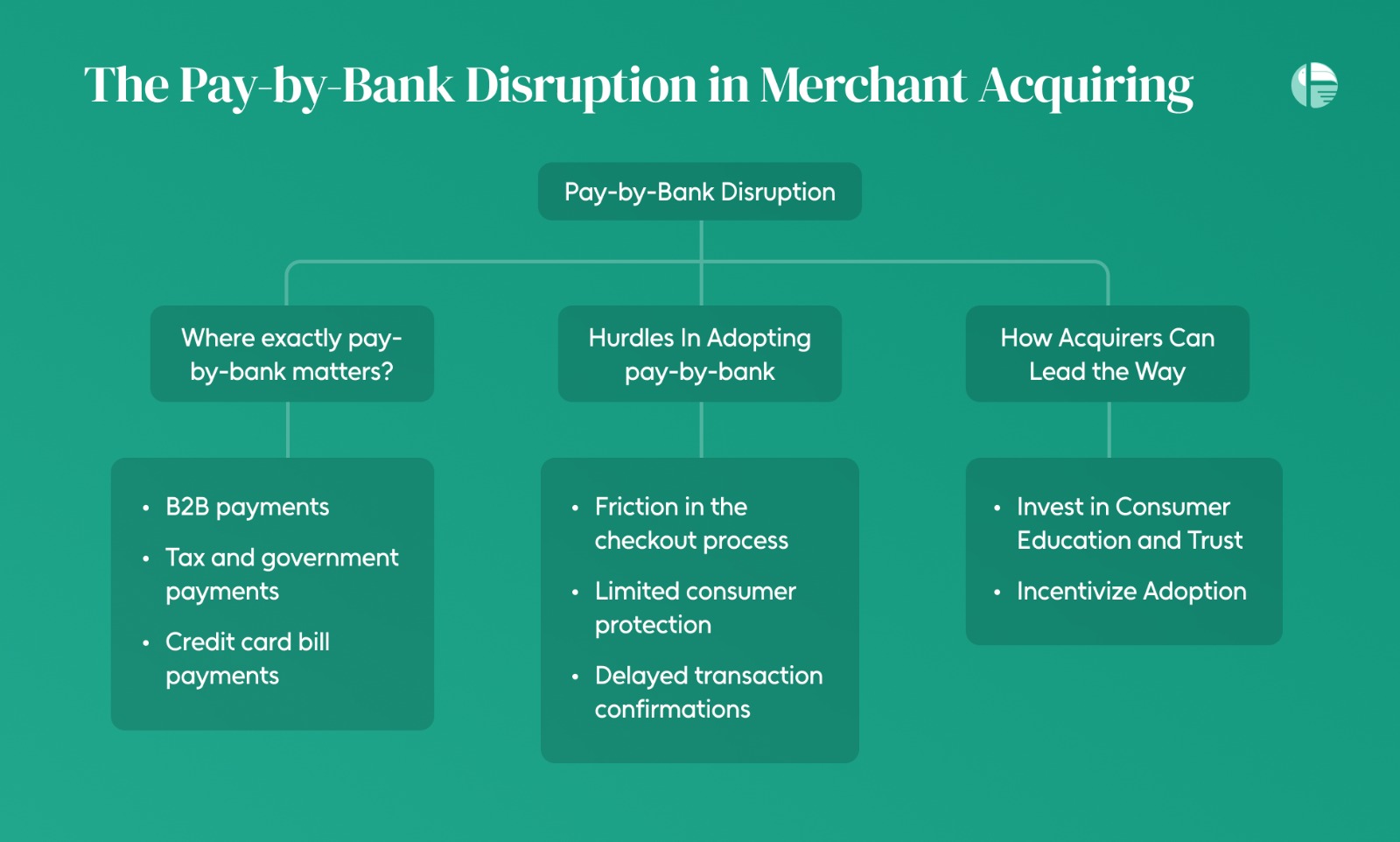

Navigating Pay-by-Bank Disruption: What Acquirers Need to Know

As the payments landscape continues to evolve, pay-by-bank—also known as open banking payments—is emerging as a disruptive force. With its promise of real-time settlement and reduced interchange fees, this payment method is gaining traction in specific use cases. However, it comes with its own set of challenges, especially for merchant acquirers navigating this shift.

Let’s dive into what pay-by-bank means for acquirers, the opportunities it presents, and the steps acquirers must take to address potential roadblocks.

The Merchant’s Perspective: Why Pay-by-Bank Matters

For merchants handling high-value transactions, pay-by-bank is a game-changer. It eliminates the hefty interchange fees associated with traditional card payments and offers near-instant settlement options. This is particularly appealing for categories like:

- B2B payments

- Tax and government payments

- Brokerage fees

- Credit card bill payments

The Challenge of Consumer Adoption

For pay-by-bank to thrive, it must compete with the convenience of existing payment methods. Key hurdles include:

- Friction in the checkout process: In-store pay-by-bank options must replicate the effortless nature of contactless payments.

- Limited consumer protection: In markets like the UK, pay-by-bank lacks the protections offered by card transactions, such as Section 75 or chargeback schemes. This makes buyers hesitant to switch.

- Delayed transaction confirmations: Unlike cards, some open banking transactions may remain unconfirmed for hours or even days, creating uncertainty for merchants managing high transaction volumes.

How Acquirers Can Lead the Way

Acquirers have a unique opportunity to address these challenges and drive the adoption of pay-by-bank payments. Here’s how:

a. Invest in Consumer Education and Trust

Merchants and buyers alike need to understand the benefits of pay-by-bank. Acquirers can collaborate with merchants to promote the advantages—such as lower costs and faster settlements—through prominent placement on websites and checkout screens.

b. Incentivize Adoption

To attract buyers, merchants may need to pass along part of the cost savings as discounts or other rewards. Acquirers can encourage creative incentive structures that make pay-by-bank more appealing to consumers.

Delivering Seamless Customer Experiences: A Competitive Advantage

When it comes to payments, being present where the customer is—both online and offline—is no longer optional. A seamless payment experience can be the difference between converting a sale and losing it.

Research consistently shows that one of the top reasons customers abandon their shopping carts is the lack of preferred payment options. This highlights a critical truth: the more seamless and inclusive the payment experience, the higher the likelihood of customer retention and satisfaction.

Why Seamless Customer Experiences Matter?

The payment landscape has become more competitive than ever. With over 350 alternative payment methods (APMs) available—ranging from digital wallets and buy-now-pay-later (BNPL) options to cryptocurrencies and loyalty points—offering flexibility at checkout has become essential. Consumers want choice, and they expect their preferred payment methods to be supported across every channel they shop in.

But the challenge doesn’t stop there. Beyond payment options, customers now demand:

- Speed: Slow or clunky payment processes drive shoppers away.

- Convenience: The checkout flow must be intuitive and frictionless.

- Security: Trust is paramount in every transaction.

Taking Bold Steps: From Early Trials to Mass Rollout

From e-commerce to FinTech, every step in a user’s journey matters—and even minor friction can derail success.

The transition from early trials to a full-scale rollout is a pivotal moment, often filled with both promise and pitfalls. Let’s explore the challenges and opportunities of scaling a solution while addressing pain points that matter most to businesses and their customers:

The Pain of Early Trials

During early trials, businesses often encounter several hurdles, including:

- Complex User Journeys: Studies show that prolonged checkout times or overly complicated processes can alienate users. For example, in Europe, the average checkout time exceeds three minutes, leading to abandonment rates above 60% within the first two minutes.

- Limited Adoption: Initial adopters may not represent the broader market. Businesses frequently struggle to move beyond this niche audience, facing resistance from new users unfamiliar with the product or service.

- Integration Issues: Whether it’s an emerging payment method or a new technology, poor integration often leads to fragmented user experiences. An average payment journey involves up to nine screens, which can significantly increase friction.

Turning Trials into Triumphs

To transition from trials to mass adoption, businesses must address these pain points head-on. Here’s how:

- Shift Left in the Journey: Early engagement is key. By embedding solutions within the product discovery phase, businesses can capture customer interest before they encounter friction points. Take inspiration from PayPal’s acquisition of Honey. By offering automatic coupon applications at checkout, PayPal reduced cart abandonment and provided value during product discovery, not just at the final step.

- Front-End Orchestration for Seamless Integration: Advanced orchestration platforms empower businesses to tailor the payment journey. Merchants can dynamically filter and sort payment methods based on a customer’s region, preferences, or past behavior, reducing complexity and creating a more personalized checkout experience.

- Test, Optimize, and Repeat: Every trial phase offers insights. An iterative approach—refining the product based on real-time feedback—ensures the final rollout aligns with customer needs.

Modernizing Payments Platforms: Embracing Cloud-Native Solutions

Digital payment volumes are surging at unprecedented rates, payments platforms are under immense pressure to stay reliable, scalable, and available. For acquirers, downtime is no longer just a technical issue—it’s a reputational and financial risk.

The need for modernization has never been greater, pushing many to transition from legacy monolithic systems to cloud-native architectures. But this journey is not without challenges. Let’s explore how acquirers can address these pain points and adopt innovative strategies:

The Case for Modernization

The rapid growth of digital payments has exposed the limitations of traditional payments platforms. Here are some key pain points acquirers face:

- Downtime and Service Disruptions: Legacy systems often struggle with high availability, leading to outages that not only frustrate customers but also result in revenue loss.

- Scaling Challenges: Monolithic platforms were not designed to handle today’s transaction volumes, making scalability a constant uphill battle.

- Operational Inefficiencies: Traditional architectures lack the agility and automation needed to adapt quickly to market demands or technological advancements.

Modernization Strategies for Acquirers

The journey to modernization isn’t one-size-fits-all. Acquirers can adopt various strategies based on their specific needs:

- Hollowing the Core: Retain the legacy system’s core while building orchestration layers to integrate modern capabilities.

- Strangler Fig Pattern: Gradually replace legacy components by running new microservices alongside the existing system until the old components are fully deprecated.

- Full Platform Overhaul: Completely replace the legacy system with a new, API-driven, cloud-native platform. While more resource-intensive, this approach ensures long-term benefits.