How Can Merchant Acquirers Tap into the MSME Payments Market?

Micro, Small, and Medium Enterprises (MSME) are the unsung heroes of global commerce, driving innovation, creating jobs, and contributing significantly to GDP. According to the United Nations, MSMEs account for 90% of businesses, 60-70% of global employment, and 50% of GDP.

Considering how crucial MSME is for economic growth this blog covers in-depth the recent growth of MSME sector especially post-covid, the 4 crucial strategies for merchant acquirers to tap into the MSME market and what are the top opportunities for merchant acquirers in the MSME industry.

The Rapid Growth of the MSME Sector

Despite their immense importance, the sector faced unprecedented challenges during the COVID-19 pandemic, which disrupted supply chains, stalled demand, and tested the resilience of businesses worldwide.

However, this adversity also sparked a transformation, accelerating the digitalization of MSMEs and reshaping how they operate in a rapidly evolving marketplace

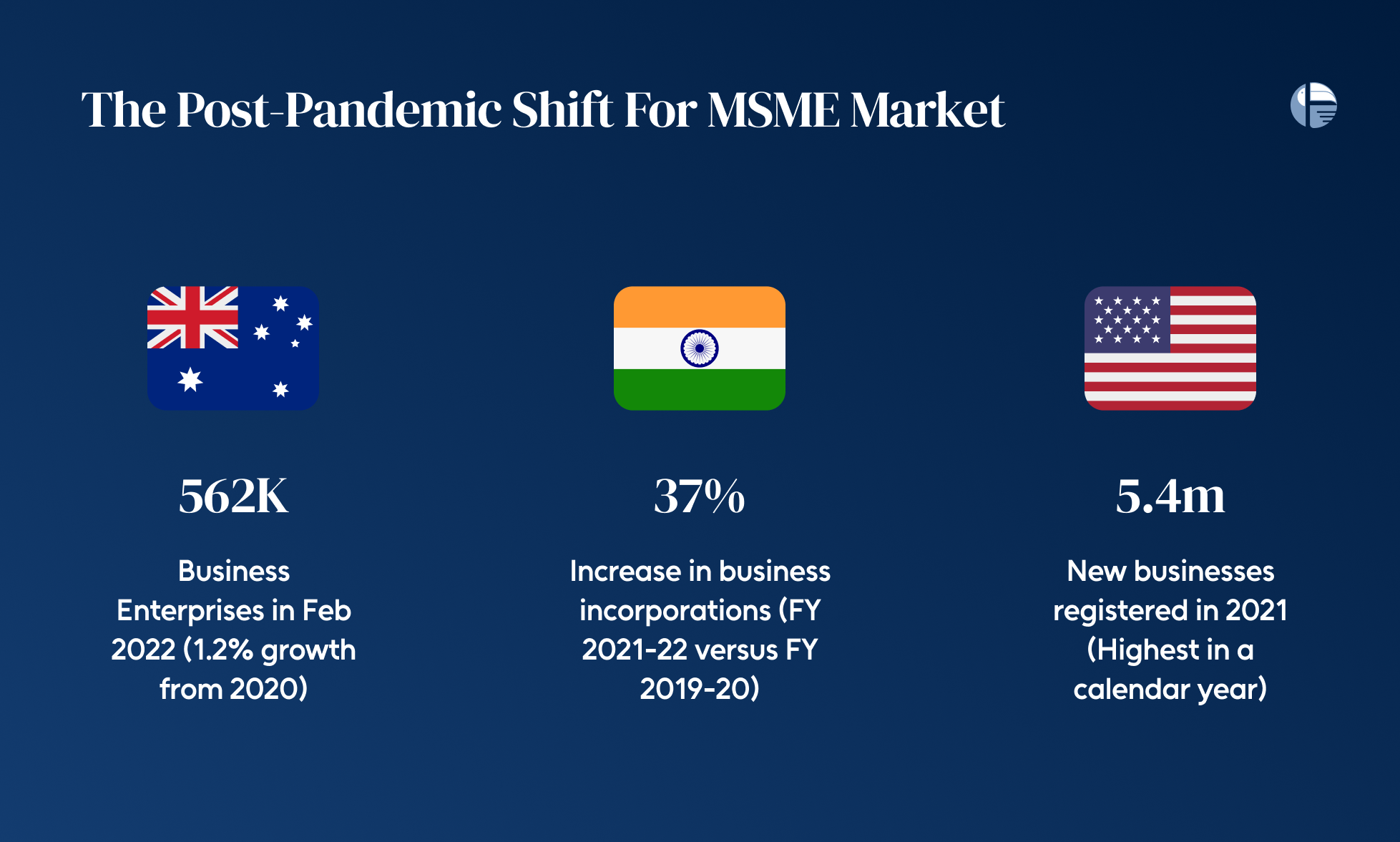

The Post-Pandemic Shift For MSME Market

While the pandemic presented significant obstacles, it also sparked a transformative shift in how MSMEs operate. With physical storefronts facing lockdowns and market uncertainties, many MSMEs quickly pivoted to digital channels.

This shift wasn’t just a survival mechanism; it became a catalyst for future growth. From e-commerce to digital payments, MSMEs rapidly adopted new technologies to reach customers, streamline operations, and stay competitive.

As the digital ecosystem grew, businesses saw a surge in new opportunities for growth. What’s fascinating is that this trend extended beyond millennials—baby boomers and Gen Z, too, became digitally savvy and increasingly reliant on online services. This broadening of the consumer base created fertile ground for MSMEs to tap into new markets

Opportunities for MSMEs in a Digital World

In this digital-first world, MSMEs have access to tools and resources that were once reserved for larger corporations. Cloud-based technologies, digital marketing, and integrated payment solutions are now more accessible and affordable.

By leveraging these tools, MSMEs can optimize their operations, enhance customer experiences, and scale rapidly.

Moreover, the rise of online platforms, including e-commerce and digital marketplaces, has made it easier for MSMEs to sell globally, leveling the playing field for small businesses.

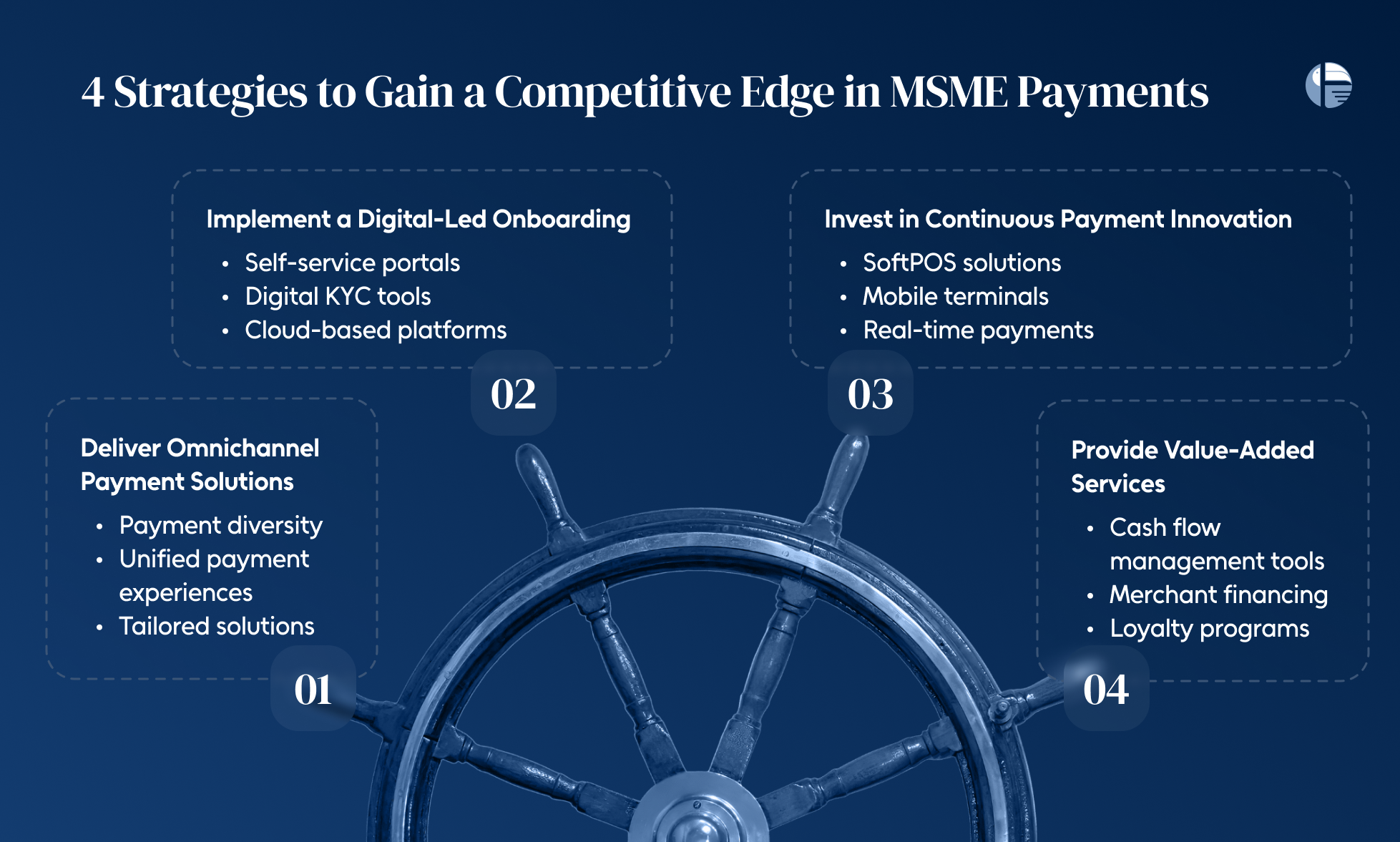

4 Strategies to Gain a Competitive Edge in MSME Payments

The Micro, Small, and Medium Enterprise (MSME) sector represents an enormous growth opportunity for merchant acquirers. As MSMEs embrace digital transformation and evolve their customer engagement strategies, their payment needs are becoming more diverse and complex.

To remain competitive and relevant, merchant acquirers must align their offerings with the unique requirements of this dynamic segment. Here are four critical strategies to gain a competitive edge in MSME payments.

1. Deliver Omnichannel Payment Solutions

MSMEs today operate across physical stores, e-commerce platforms, and mobile apps, catering to customers with varying payment preferences. Merchant acquirers must ensure their solutions support seamless transactions across multiple channels.

Key focus areas:

- Payment diversity: Enable MSMEs to accept cards, real-time payments, e-wallets, and recurring billing

- Unified payment experiences: Integrate payment methods across in-store, online, and mobile channels for frictionless customer journeys

- Tailored solutions: Offer industry-specific payment features, such as QR code payments for small retailers or subscription billing for service providers.

By enabling omnichannel payment capabilities, acquirers can position themselves as indispensable partners in an MSME’s growth journey.

2. Implement a Digital-Led Onboarding

Traditional onboarding processes are no longer viable in today’s fast-paced environment. MSMEs seek quick, seamless, and hassle-free ways to access payment solutions. Merchant acquirers can gain a competitive advantage by adopting digital-led onboarding and servicing models.

Best practices include:

- Self-service portals: Allow MSMEs to apply for payment solutions independently, reducing manual intervention

- Digital KYC tools: Automate identity verification for faster approvals.

- Cloud-based platforms: Leverage open architecture to integrate with third-party services and expand capabilities.

Efficient onboarding not only accelerates time-to-market for MSMEs but also enhances their experience, fostering long-term relationships.

3. Invest in Continuous Payment Innovation

The payments landscape is evolving rapidly, and MSMEs expect cutting-edge solutions to stay competitive. Merchant acquirers must invest in innovative technologies to differentiate their offerings.

Recent innovations include:

- SoftPOS solutions: Enable card acceptance via smartphones without additional hardware, ideal for on-the-go businesses.

- Mobile terminals: Compact devices that allow MSMEs to accept payments at customer locations or pop-up events.

- Real-time payments (RTP): Ensure instant funds transfer at checkout for both in-store and online transactions.

Innovation not only meets the growing demands of MSMEs but also strengthens an acquirer’s reputation as a forward-thinking payments partner.

4. Provide Value-Added Services Beyond Payments

To stand out, merchant acquirers need to offer more than just payment processing. MSMEs require tools and services that support their overall business growth and sustainability.

Examples of value-added services:

- Cash flow management tools: Use predictive analytics to provide insights into income and expenses, helping MSMEs manage finances effectively.

- Merchant financing: Offer short-term loans or credit facilities to support working capital needs.

- Loyalty programs: Enable MSMEs to create and manage customer rewards programs to drive retention and repeat business.

These additional services create stickiness, enhance customer satisfaction, and open up new revenue streams for acquirers.

What Opportunities Exist for Merchant Acquirers in MSME Financing?

The Micro, Small, and Medium Enterprise (MSME) sector is the backbone of economies worldwide, driving innovation, employment, and economic growth. However, one of the persistent challenges MSMEs face is access to financing.

For merchant acquirers, this challenge represents an untapped opportunity to bridge the gap, offering tailored solutions that meet the unique needs of MSMEs while unlocking new revenue streams.

Let’s explore the opportunities in MSME financing and how merchant acquirers can play a pivotal role in addressing this critical need:

Why Do MSMEs Need Financing?

MSMEs face significant challenges in securing financing due to the inefficiencies of traditional lending systems. Limited credit history, lengthy and burdensome loan application processes, opaque approval criteria, and delayed disbursements make it difficult for small businesses to access the capital they need.

Moreover, rigid repayment structures fail to account for the fluctuating revenue cycles that define most MSMEs. These barriers create a substantial financing gap, presenting a unique opportunity for merchant acquirers to step in.

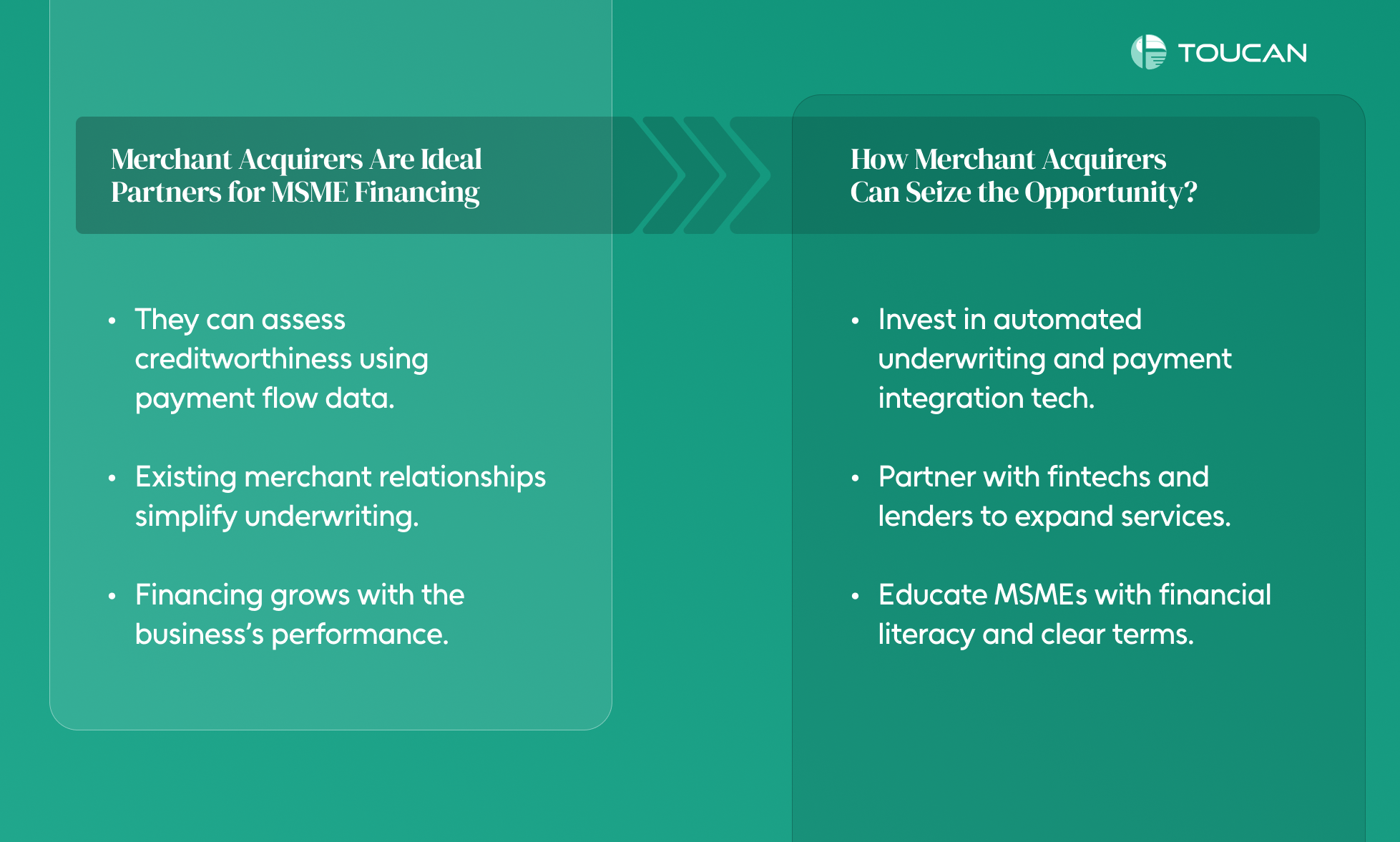

Why Merchant Acquirers Are Ideal Partners for MSME Financing?

Merchant acquirers are already deeply embedded in MSMEs’ financial ecosystems, giving them unparalleled access to data and insights. Here’s why they are well-suited to address MSME financing needs:

- Data-Driven Insights: Merchant acquirers have visibility into payment flows, helping them assess creditworthiness accurately.

- Existing Relationships: Many acquirers have already onboarded merchants, simplifying the underwriting process.

- Scalable Credit Limits: Financing can grow in tandem with the business’s performance, ensuring flexibility and alignment.

How Merchant Acquirers Can Seize the Opportunity?

To tap into the MSME financing market, merchant acquirers need to:

- Invest In Technology: Invest in platforms that automate underwriting and integrate with payment systems.

- Partner with Ecosystems: Collaborate with fintech companies and alternative lenders to broaden service offerings.

- Educate MSMEs: Build trust by offering financial literacy resources and transparent terms.

The financing gap for MSMEs is surely a challenge, but it’s also a golden opportunity for merchant acquirers. By addressing the pain points of MSME financing with innovative, flexible solutions, acquirers can drive growth for merchants and themselves.

Now is the time to step up and bridge the gap—because when MSMEs thrive, the economy thrives.