AI-Powered Payment Orchestration Platform

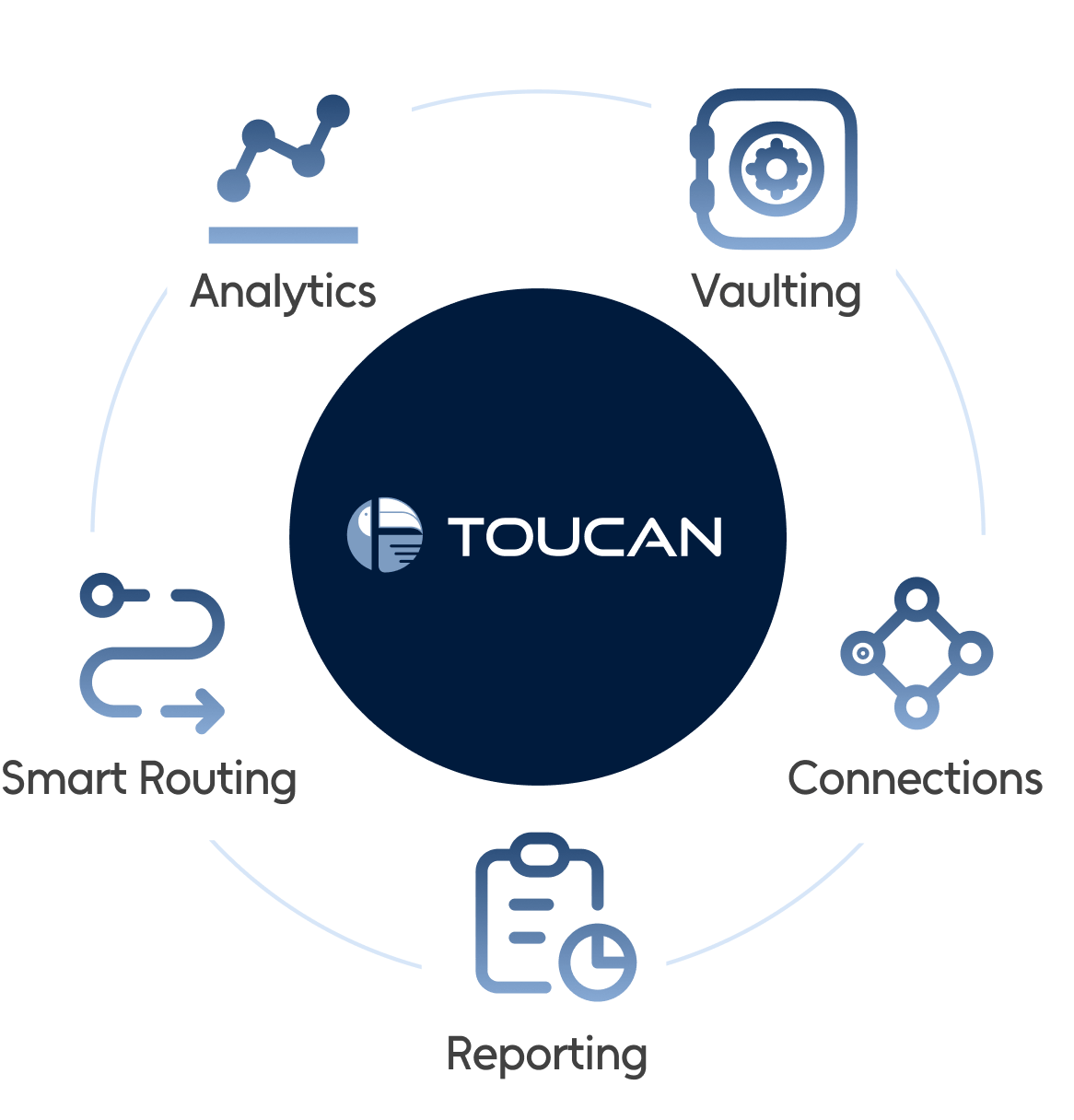

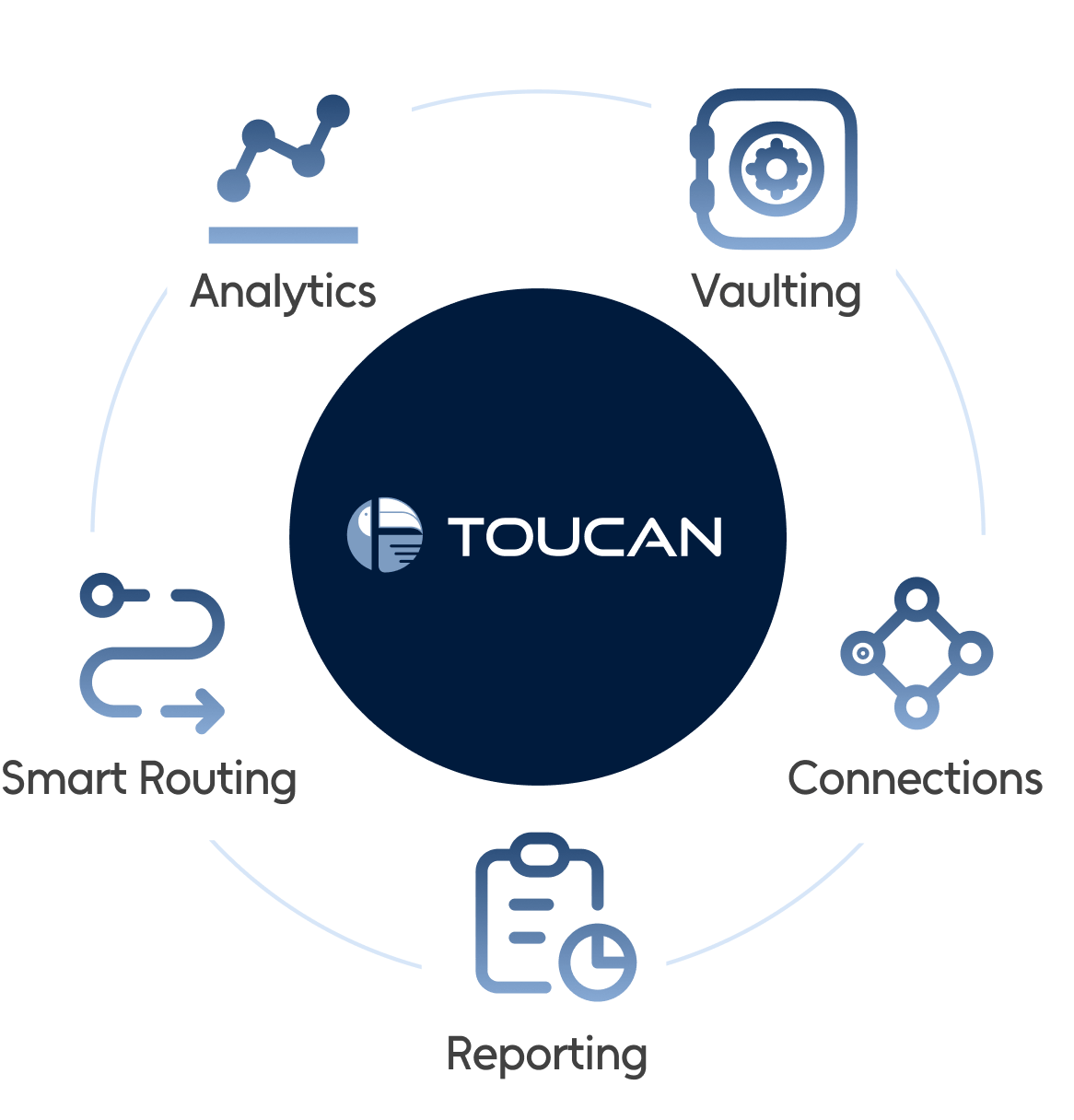

SuperStream by Toucan is a smart payment orchestration platform that enhances approval rates with its unified, real-time payment infrastructure.

- 50+ payment processors

- 200+ payment methods

- 100+ currencies

$1.5 billion

in transaction processing

15 countries

Deployments globally

10 million

users across four continents

Trusted By

Intelligent Orchestration with Superstream

Power smarter payments with SuperStream features

AI Fraud

Detection

SuperStream protects payments by identifying threats with real-time alerts, machine learning, and risk scoring to flag suspicious transactions.

Intelligent

Routing

Rule-based routing

Volume-based distribution

Machine-learning-driven

adaptive routing

Native Checkout Experience

Deliver seamless cross-platform payments with native checkout, optimizing conversions with fast, secure, and intuitive options on web and mobile.

Smart Data

Analytics

SuperStream’s AI-driven analytics deliver real-time insights to optimize payments, predict trends, and generate custom reports.

Hassle- Free

Compliance

Stay secure and compliant with PCI L1 and PCI SSS certifications, ensuring your payments meet the highest industry standards.

Unmatched Uptime & Scalability

With 99.99% uptime and robust cloud infrastructure, we ensure uninterrupted payments & scalable solutions for millions of transactions.

Automated Transaction Reconciliation

Effortlessly match payments with purchase orders, improving accuracy, reducing manual errors, and enhancing overall operational efficiency.

Centralized Control Center

Gain visibility with an intuitive interface. Track analytics, process refunds, manage chargebacks, & streamline reconciliation in one platform.

Ready to build simplified payment experiences?

Key Benefits of SuperStream Payment Orchestration

Power your payments, boost your profits, and scale with confidence

Fast Transaction Processing

Optimized sharded database storage for high-performance, real-time payment streaming.

Scalable Payment Infrastructure

Easily deploy and scale payment solutions with flexible, scalable architecture.

Global Payment

Reliability

Multi-region availability with data centers ensuring high uptime and disaster recovery.

Uncompromised Payment Security

Advanced encryption with asymmetric keys, protecting sensitive data from end to end.

Boost Authorization Rates by 10%

Connect with global bank acquirers to reduce processing latency by 20% and enhance approval rates.

Streamline Payment Operations

Gain an end-to-end view of payments with user controls and automatic reconciliation of transaction reports.

Seamless Checkout Experience

Leverage 3DS 2.0 authentication for enhanced security and provide a unified, native checkout experience across all platforms.

Empowering Success Stories of Businesses

Shubham Jain

Sales and Business Development lead

EDUQFIXThe feature-rich Toucan application and deep expertise allow us to add new features and functionalities through simple API plug-ins. This complements our platform and provides end-to-end services, enhancing the customer experience with ease.

Kishor Fogla

CEO

Bhagwaanji.comThe Toucan team has played a key role in implementing end-to-end transaction journeys as required by the business. The Toucan platform is a delight for operations, offering easy plug-ins and integration, significantly boosting productivity.

Ansar Memon

Head Operations

Shopeefix.comToucan is easy to integrate and simplifies operations. With insightful dashboards, detailed MIS reports, and an intuitive user interface, it has greatly enhanced the value proposition for Shopeefix merchants, improving decision-making and operational efficiency.

Shivaraj Upadhyaya

Head-Digital Banking

NMB Bank LimitedThe partnership with PayNet Systems transformed NMB Bank's operations, establishing it as a leader in Nepal’s banking industry. This collaboration demonstrates the transformative power of technology-driven solutions in enhancing customer experiences in finance.

Pawan Pradhan

Managing Director

Cellcom Pvt LtdCellcom has become the fastest-growing payments ecosystem in the region, enabling P2P, P2M, and P2G payments. This growth has significantly improved customer engagement & operational efficiency for Nepal Merchant Bank, reinforcing its leadership in the market.

Saurav Shrestha

Head Digital Banking

KSB Bank LtdPayNet deployed a secure social banking platform, enabling customers to open accounts and perform transactions via Viber & Facebook Messenger. The intelligent chatbot helps users explore products & securely capture KYC data through encrypted chat sessions.

Build a Powerful, Optimized Framework with Our Product Suite

Tokenization

Secure your transactions with advanced tokenization, replacing sensitive data with encrypted tokens to prevent fraud.

Digital Wallet

Empower users with our digital wallet solution, enabling quick, secure, and cashless transactions across platforms.

Digital Identity Solutions

Real-time fraud prevention technology designed to increase conversion and block sophisticated fraudsters.

Frequently Asked Questions

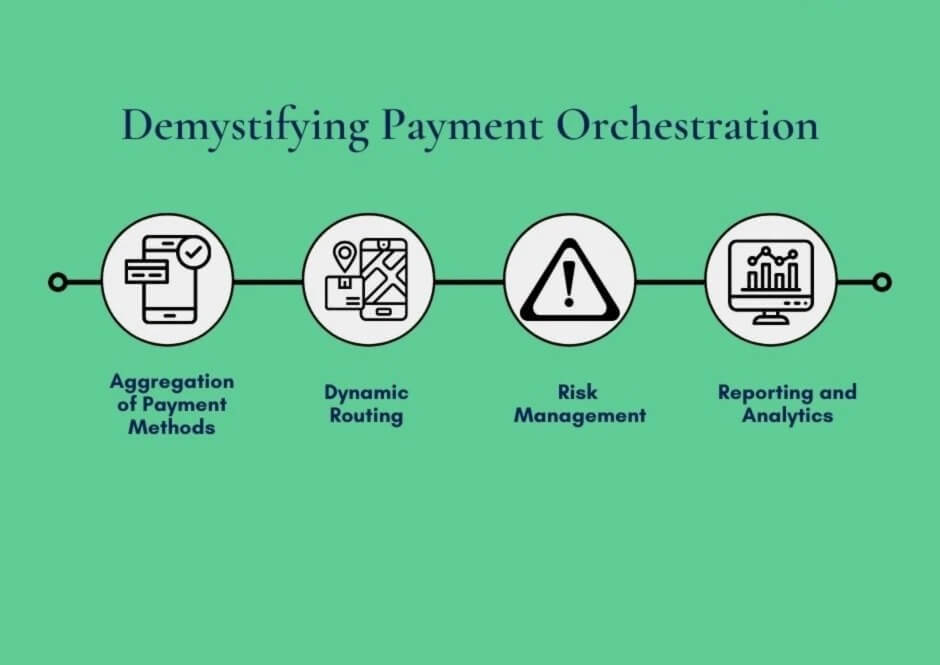

Payment orchestration is a powerful solution that gives businesses full control over the entire payment process. By connecting to multiple payment service providers (PSPs) and gateways through a single API, SuperStream simplifies the complexities of payment management. Our platform acts as a seamless layer between your e-commerce platform and payment processors, unlocking new levels of flexibility, cost-efficiency, and scalability. With SuperStream, merchants can easily integrate a wide range of payment methods, tailor payment experiences to customer preferences, and optimize payment routing to minimize transaction costs.

Smart payment routing is a dynamic solution that optimizes payment processing by automatically directing transactions through the most efficient payment processor based on factors like cost, region, and customer preference. For businesses selling globally or operating across multiple regions, the need to integrate with various payment providers is essential to meet customer needs and ensure flexibility. SuperStream’s Smart routing allows you to switch between processors seamlessly, minimizing downtime and reducing payment processing costs.

Payment orchestration is crucial for businesses looking to optimize their payment processes, reduce costs, and improve customer experience. By acting as a centralized hub, payment orchestration platforms like SuperStream can connect multiple payment service providers (PSPs), payment gateways, and alternative payment methods (APMs) through a single API, providing businesses with unparalleled flexibility and control.

A payment orchestrator and a payment gateway are both crucial components in the payment ecosystem, but they serve different roles and offer distinct advantages for businesses. A payment gateway is a service that facilitates the authorization and processing of online payments between merchants and customers. It acts as a bridge between the customer’s payment method (e.g., credit card, e-wallet) and the merchant's payment processor. Here’s how they differ: Functionality: A payment orchestrator offers broader functionality by managing multiple payment gateways and processors in one platform, while a payment gateway focuses solely on authorizing payments. Flexibility and Control: Payment orchestrators provide greater control over payment routing and transaction management, allowing businesses to select the best payment provider for each transaction. Payment gateways, however, usually only work with one processor. Cost Optimization: Payment orchestrators allow businesses to reduce transaction fees by choosing the most cost-effective routes, whereas payment gateways typically work with a fixed processor, limiting flexibility in fee management.

An excellent example of payment orchestration software is SuperStream, a leading platform that empowers businesses to streamline their payment processes, reduce transaction costs, and improve payment success rates. Key features of SuperStream payment orchestration software includes: Smart payment routing that increases transaction approval rates and reduces payment failures Multi-currency support for global payment processing Seamless integrations with popular payment gateways and processors Advanced fraud detection and security features to protect sensitive customer data.

Payment orchestration simplifies and optimizes payment processing by integrating multiple payment gateways, payment service providers (PSPs), and alternative payment methods (APMs) through a single platform. With smart payment routing, the system automatically selects the most cost-effective and reliable payment processor based on factors like region, fees, and transaction success rates. This ensures higher approval rates, lower costs, and a seamless checkout experience for customers.

Payment orchestration platforms do more than just simplify transactions—they help businesses stay ahead of evolving payment regulations and security standards. Here’s how: Centralized Payment Management: By integrating multiple payment gateways, payment service providers (PSPs), and multiple payment methods into one platform, payment orchestration solutions like SuperStream offer a centralized payment management system. This makes it easier for businesses to adhere to PCI DSS compliance and other payment security standards, ensuring data protection and regulatory adherence. Automated Regulatory Updates: As payment regulations constantly evolve, keeping up with changes can be challenging. Payment orchestration platforms automatically update businesses on regulatory changes, ensuring they stay compliant without the need for manual monitoring. This helps reduce the risk of non-compliance and potential fines, while also improving operational efficiency.