From Payments to Profit: All About Merchant Acquiring

The payment industry in general is observing a paradigm shift and the merchant acquiring sector is subject to some of the biggest changes.

In this blog, we’ll gain an answer to crucial questions related to the term merchant acquiring meanwhile also looking into its benefits in order to understand how merchant acquiring sets businesses from payments to profits.

What is Merchant Acquiring?

At its core, merchant acquiring refers to the process by which businesses (merchants) are enabled to accept payment methods like credit and debit cards. This process is facilitated by merchant acquirers, often banks or financial institutions, who act as the bridge between the merchant, payment networks (like Visa and Mastercard), and issuing banks.

The acquirer ensures that payments from customers flow seamlessly into the merchant’s account while handling the behind-the-scenes complexities like authorization, settlement, and fraud prevention.

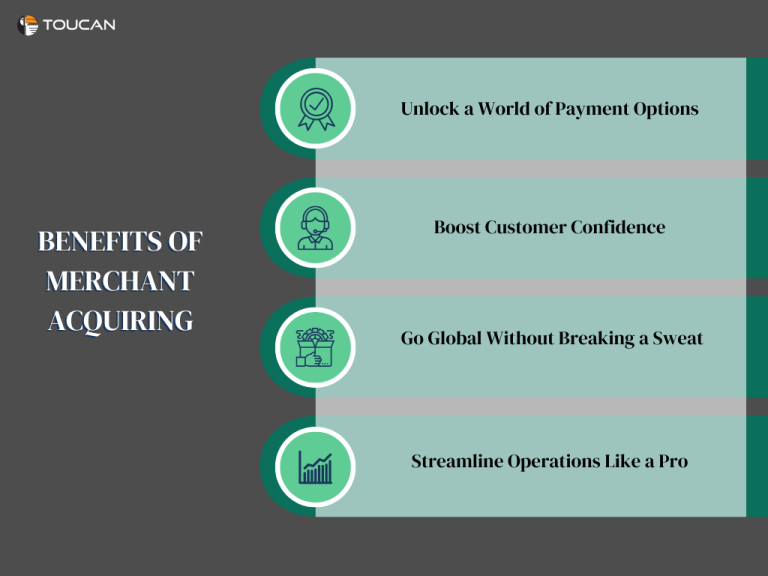

What Are The Benefits Of Merchant Acquiring?

Have you ever wondered how businesses manage to accept all those credit cards, mobile wallets, and other digital payment methods with ease? That’s where merchant acquiring comes into play. But let’s not dive into technical jargon just yet. Instead, let’s focus on why merchant acquiring is a game-changer for businesses of all sizes and how it can transform the way you operate

1. Unlock a World of Payment Options

Imagine being able to say “Yes!” to every payment method your customers prefer—whether it’s a credit card, a mobile wallet, or even Buy Now, Pay Later (BNPL) options. Merchant acquiring makes this possible by enabling businesses to accept payments across a variety of channels.

Why does this matter? Well, more payment options mean fewer abandoned carts and happier customers. Plus, who doesn’t love giving their customers the freedom to pay how they want?

2. Boost Customer Confidence

Let’s face it—trust is everything in today’s competitive market. Merchant acquiring allows businesses to offer secure, reliable payment systems backed by advanced fraud protection measures.

When customers see trusted payment options like Visa, Mastercard, or Apple Pay, they’re more likely to complete their purchase. And the best part? They’ll feel safe doing so, which means they’ll keep coming back for more.

3. Go Global Without Breaking a Sweat

Dreaming of expanding your business beyond borders? Merchant acquiring makes it simple. With cross-border transaction capabilities and support for multiple currencies, you can cater to international customers effortlessly.

Your business gets to accept payments from around the world while offering seamless conversions. Translation? A bigger audience, higher sales, and no need to worry about complicated exchange rates.

4. Streamline Operations Like a Pro

Let’s talk efficiency. Merchant acquiring simplifies the payment process by handling everything from authorization to settlement. This means fewer headaches for you and your team.

Even better, many acquirers provide user-friendly dashboards where you can track transactions, manage disputes, and gain insights into customer behavior—all in one place. Who wouldn’t want to save time and work smarter?

What Is The Difference Between Merchant Acquiring vs Payment Processor?

Payment processing is the technology behind every electronic transaction. A payment processor acts as a middleman, ensuring that funds move securely and efficiently between the customer, the business, and the bank.

Here’s what payment processors do:

They verify and authorize transactions in real-time by communicating with card networks (like Visa or Mastercard) and issuing banks.

They handle data encryption and fraud prevention to keep sensitive information safe.

Payment processors often integrate with point-of-sale (POS) systems, e-commerce platforms, and other tools to streamline payment acceptance.

Key Differences Between Merchant Acquiring and Payment Processing

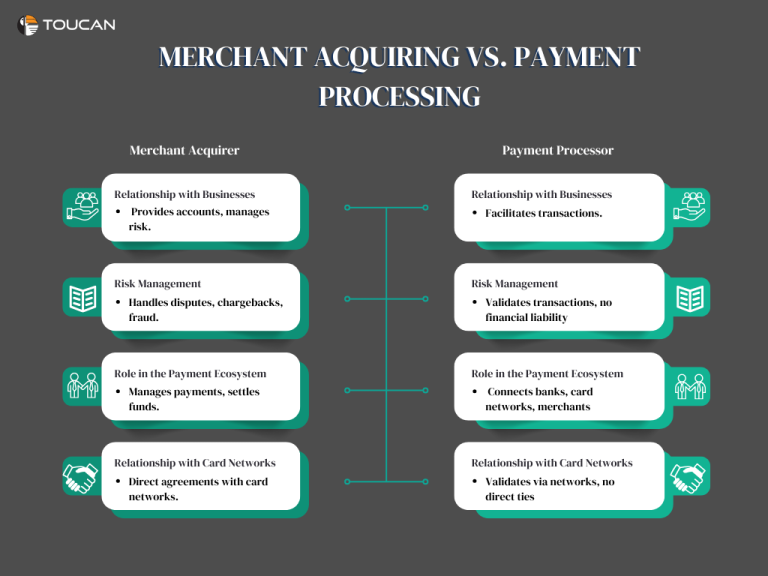

1. Relationship with Businesses

Merchant Acquirer: Works directly with the business by providing a merchant account and managing risk.

Payment Processor: Often works behind the scenes, enabling transactions on behalf of the business.

2. Risk Management

Merchant Acquirer: Assumes financial risk for disputes, chargebacks, and fraud.

Payment Processor: Focuses on transaction validation and security but does not take on financial liability.

3. Role in the Payment Ecosystem

Merchant Acquirer: Acts as the business’s primary partner for handling card payments and settling funds.

Payment Processor: Serves as the technical bridge, facilitating communication between banks, card networks, and the merchant.

4. Relationship with Card Networks

Merchant Acquirer: Maintains agreements with card networks (e.g., Visa, Mastercard) and plays an integral role in the authorization and settlement process.

Payment Processor: Communicates with card networks to validate transactions but does not have a direct agreement with them.

What Is Impact Of Regulations On Merchant Acquiring?

From driving adoption to ensuring fair practices, regulatory frameworks influence how businesses accept payments and how acquiring banks operate. Let’s explore how regulations impact merchant acquiring, both in India and globally, and what businesses can expect moving forward.

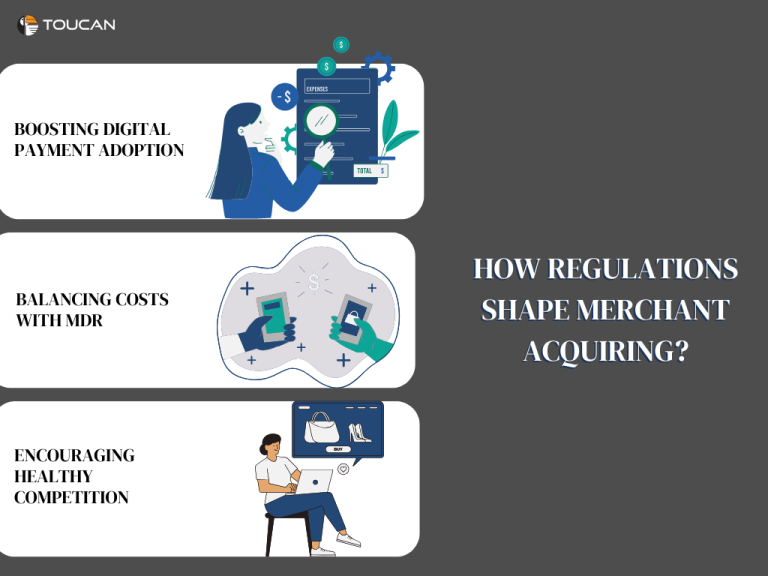

How Regulations Shape Merchant Acquiring

At its core, merchant acquiring involves enabling businesses to accept card and digital payments securely. Regulations influence this process by setting standards, determining costs, and fostering innovation. Here’s a closer look:

Boosting Digital Payment Adoption

Governments worldwide have implemented policies to encourage businesses to embrace digital payments. Incentives like reduced fees, merchant subsidies, and terminal deployment targets have significantly expanded card acceptance infrastructure.

Balancing Costs with MDR

Merchant Discount Rate (MDR)—a fee charged for processing payments—is a key area of regulation. Lower MDR rates make it easier for small businesses to adopt card payments, but these reductions also affect the revenue of acquiring banks.

Encouraging Healthy Competition

Regulations often push banks and payment companies to compete in deploying terminals, onboarding merchants, and expanding coverage. This fosters innovation and ensures merchants have access to better services.

The Indian Context: Pioneering Change

In India, regulatory measures have reshaped the acquiring landscape dramatically:

MDR Rationalization: In 2017, the Indian government revised MDR rates to 0.4% for small merchants and 0.9% for larger merchants for debit card transactions. QR transactions enjoyed an additional 10 basis points discount.

Subsidized MDR for Small Transactions: To boost digital payments for transactions under ₹2000, the government bore the MDR cost, reimbursing acquiring banks. While this initiative eased the burden on merchants, operational challenges have raised questions about its sustainability.

Terminal Deployment Targets: The Ministry of Electronics and Information Technology (MeitY) introduced hard targets for deploying POS terminals and QR codes, spurring public and private sector banks to scale their acquiring operations.

Despite these advancements, challenges remain. High interchange fees, which form the largest portion of MDR, remain unregulated, leaving merchants to bear the brunt of costs.

Global Regulatory Trends in Merchant Acquiring

Around the world, regulations have had a transformative effect on acquiring businesses:

The U.S. Durbin Amendment (2011): This regulation capped debit card interchange fees for larger banks, reducing them to 0.05% + $0.21 per transaction. While MDR wasn’t significantly affected, acquirers saw improved margins.

EU Regulation (2015/751): Europe capped interchange fees at 0.2% for debit card transactions and 0.3% for credit cards. This move not only increased card transactions but also boosted profits for acquirers.

Other Countries: Nations like Australia and Canada have implemented similar interchange regulations, reducing costs for merchants and driving higher card acceptance rates. These policies show how well-designed regulations can spur adoption, improve transparency, and enhance margins for both merchants and acquirers.

What Are The Challenges In Merchant Acquiring?

The merchant acquiring landscape has seen explosive growth, driven by the rise of digital payments and innovations in financial technology. But with opportunity comes a set of unique challenges that acquiring banks, fintech companies, and payment service providers must navigate. Here are some of the challenges in merchant acquiring:

Fierce Competition: A Double-Edged Sword

The entry of fintech companies, non-bank players, and digital-first payment processors has intensified competition in the merchant acquiring space. While this innovation benefits merchants by offering more choices and lower fees, it creates challenges for acquirers, such as:

Price Wars: To attract merchants, acquirers often engage in aggressive pricing strategies. Offering lower fees and enticing terms can shrink profit margins, making it harder to maintain financial stability.

Merchant Retention: With so many options, merchants can easily switch providers. Acquirers must continually innovate and offer unparalleled service to stay ahead.

Market Saturation: The Fight for Merchants

The merchant acquiring market is becoming increasingly crowded. Banks, fintechs, and payment platforms are all vying for the same pool of merchants. This saturation leads to:

Limited Growth Potential: In saturated markets, acquiring new merchants becomes harder, especially for smaller players who lack the resources of established firms.

Pressure to Differentiate: Acquirers must go beyond basic payment processing, offering advanced analytics, customer insights, and tailored solutions to stand out.

Rising Operational Costs

As technology and security standards evolve, the cost of maintaining and improving infrastructure has surged. Acquirers face several cost-related challenges:

Compliance and Security: With increasing regulatory scrutiny, acquirers must invest heavily in anti-money laundering (AML), data protection, and PCI DSS compliance.

Technology Investments: Merchants demand seamless, omnichannel payment experiences. Acquirers must constantly upgrade their systems to stay relevant, which adds to operational expenses.

Customer Support: Providing top-notch customer service, especially to small and medium businesses, requires significant resources.

Fraud and Security Risks

Fraud and data breaches are ever-present threats in the payments industry. Merchant acquirers bear a significant portion of the risk associated with:

Chargebacks: High levels of chargebacks not only hurt revenue but can also damage relationships with merchants.

Cybersecurity Threats: As digital payment adoption grows, so does the sophistication of cybercriminals. Acquirers must invest in cutting-edge security tools to protect themselves and their merchants.