How Will Instant Payments Evolve?

Instant payments are transforming the financial landscape, offering unparalleled speed and convenience for both consumers and businesses.

With digital transactions becoming the norm, the evolution of instant payment systems is a hot topic. As we approach 2025, let’s explore how this revolutionary trend is shaping up, what advancements we can expect, and how it will impact the global economy.

Instant payments are transactions processed in real-time, with funds transferred from sender to receiver within seconds, regardless of the time or day.

They eliminate the traditional delays caused by banking hours or clearing processes, making them highly convenient for:

E-commerce transactions: Boosting checkout efficiency.

Bill payments: Ensuring immediate settlements.

Peer-to-peer (P2P) transfers: Making quick money transfers between individuals.

In 2025, these payments are set to grow exponentially as businesses and consumers demand faster, more efficient financial solutions.

What Are The Challenges For Instant Payment Adoption

Instant payments are reshaping the way we transact, offering speed and convenience unmatched by traditional payment methods. However, while the adoption of instant payments is growing, several challenges must be addressed for seamless implementation:

1. Technical Challenges: Building Scalable Infrastructure

Handling the sheer volume of instant payment transactions is no small feat. Banks and payment providers must:

Upgrade IT systems to support real-time processing and manage millions of transactions daily.

Ensure robust network connectivity to minimize downtime and disruptions.

Address data management complexities, as instant payments require real-time access to customer and transaction data.

For many institutions, shifting transactions from traditional card networks to in-house infrastructure adds another layer of complexity, requiring significant investment in technology.

2. Security Concerns: Adapting Fraud Prevention Measures

With instant payments, transactions are completed within seconds, leaving little time for fraud detection. Challenges include:

Implementing real-time fraud monitoring systems that can detect and block suspicious transactions instantly.

Updating anti-money laundering (AML) processes to align with the speed of real-time payments.

Balancing seamless user experiences with stringent security measures, such as multi-factor authentication and biometric verification.

3. Liquidity Management: Around-the-Clock Operations

Instant payments require 24/7 liquidity to ensure that funds can be settled in real-time. Banks face challenges such as:

Maintaining sufficient liquidity across accounts to avoid credit defaults.

Developing automated liquidity monitoring tools to track and manage funds continuously.

Integrating centralized payment hubs to streamline operations and reduce manual interventions.

Without proper liquidity management, the efficiency of instant payments can be compromised.

4. Organizational Challenges: Bridging the Skills Gap

Adopting instant payments involves rethinking traditional business models and workflows. Challenges include:

Hiring specialists who can drive digitization and manage the complexities of real-time payments.

Aligning internal processes to meet the demands of instant payments, such as faster dispute resolution and continuous monitoring.

Fostering a culture of innovation to keep pace with technological advancements and market trends.

Organizations that fail to adapt risk falling behind in the competitive payment landscape

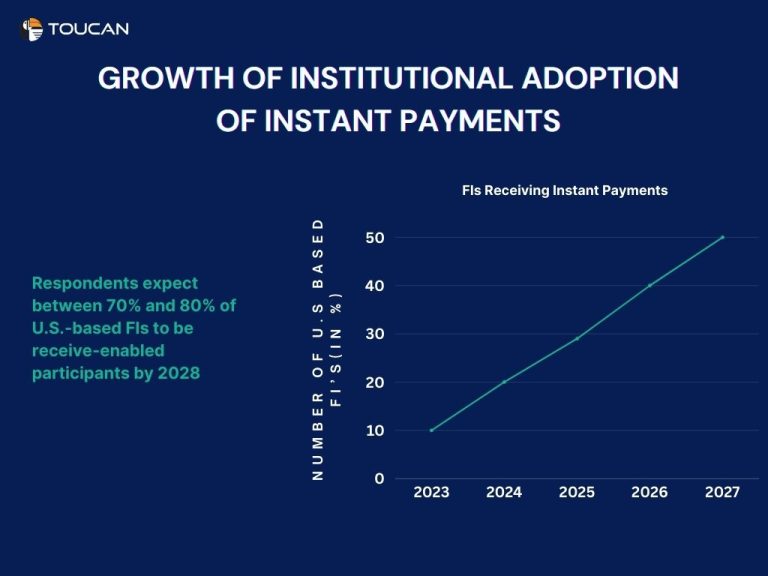

How Is Institutional Adoption of Instant Payments Growing Year by Year?

Instant payments are transforming the financial landscape, offering unparalleled speed and convenience for businesses and consumers alike. The institutional adoption of instant payments is accelerating year after year, driven by evolving use cases, technological advancements, and a growing demand for real-time financial solutions.

Let’s explore how financial institutions (FIs) are embracing this revolution and what’s driving the momentum:

1. Rising Participation Among Financial Institutions

By 2028, industry experts anticipate that 70% to 80% of U.S.-based financial institutions will be equipped to receive instant payments. This remarkable growth is fueled by strategic use cases such as:

Mobile wallet funding and defunding, making it easier for users to manage digital wallets in real-time.

Earned wage access, enabling workers to instantly access their earnings.

Government disbursements ensure faster delivery of benefits and relief payments.

As institutions increasingly integrate instant payment capabilities, consumers will enjoy quicker and more reliable transactions, fostering broader adoption.

2. Expanding Sending Capabilities

While receiving instant payments is becoming more common, sending capabilities are also on the rise.

By 2028, 30% to 40% of U.S.-based FIs are expected to support sending instant payments. This growth is being shaped by several factors:

Advanced fraud tools that enhance transaction security.

Alias tools allow users to send money using phone numbers or email addresses instead of account numbers.

The integration of instant payment options into user-friendly apps and interfaces.

3. Key Use Cases Driving Adoption

Institutions are actively exploring and implementing instant payment solutions to address diverse use cases, including:

E-commerce: Instant payments streamline checkout processes, reducing cart abandonment rates and enhancing customer satisfaction.

Business-to-business (B2B) transactions: Companies can settle invoices instantly, improving cash flow and operational efficiency.

Peer-to-peer (P2P) payments: Apps like Venmo and Zelle make transferring funds between individuals fast and seamless.

These practical applications demonstrate the real-world value of instant payments, encouraging more institutions to invest in this technology.

4. Challenges and Opportunities

While adoption is growing, challenges remain. Financial institutions must address:

Fraud prevention: As transaction speed increases, so does the risk of fraudulent activity. Robust security measures are critical.

Technology integration: Upgrading legacy systems to support instant payments requires significant investment and planning.

Regulatory compliance: Institutions must navigate complex regulatory landscapes to ensure compliance across jurisdictions.

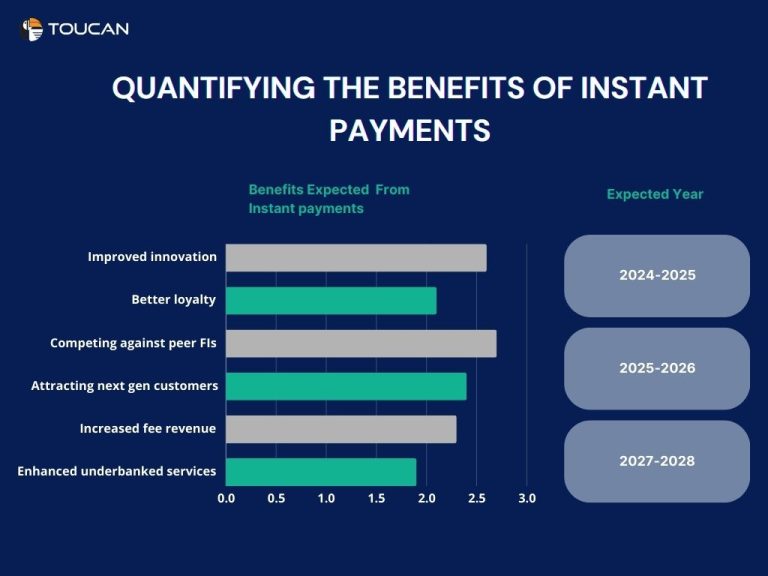

How Can We Quantify the Benefits of Instant Payments Over Time?

We now know that instant payments are transforming the way we move money, transactions are faster, more efficient, and more accessible. But how do we measure the long-term benefits of this revolutionary payment method?

From enhancing customer satisfaction to driving innovation and financial inclusion, the advantages of instant payments grow exponentially as adoption expands.

1. Immediate Impact: Driving Customer Retention and Innovation

When businesses adopt instant payments, the first noticeable benefit is improved customer satisfaction. In a world where speed matters, providing instant financial transactions is a game-changer. Customers can:

Receive refunds instantly, boosting trust in the brand.

Pay bills or make purchases seamlessly, enhancing user experience.

For businesses, this creates a competitive edge. Innovation thrives, as companies develop faster, smarter systems to cater to evolving customer needs. This not only attracts new clients but also strengthens loyalty among existing ones, ensuring long-term retention.

2. Midterm Gains: Attracting Next-Gen Customers

As the payment network matures, the benefits extend beyond immediate transactions. Financial institutions and businesses can leverage instant payments to:

Attract next-gen customers, particularly millennials and Gen Z, who demand speed and convenience in financial services.

Compete effectively in crowded markets by offering faster and more reliable payment options.

Grow deposits and expand their customer base, thanks to a seamless and tech-forward approach.

In this phase, instant payments become a differentiator in competitive industries, helping businesses stay ahead in the race for market share.

3. Long-Term Rewards: Unlocking Full Potential

The true power of instant payments is unlocked over time as the network scales and new use cases emerge. These include:

Reaching the underbanked population, providing them with real-time financial solutions, and improving financial inclusion.

Enhancing revenue streams by tapping into innovative payment ecosystems such as real-time payroll, gig economy payouts, and peer-to-peer transfers.

Supporting cross-border transactions, enabling businesses to operate globally with minimal friction.

As adoption grows, the benefits multiply, creating a virtuous cycle of innovation, inclusion, and profitability for all stakeholders involved.

How to Measure the Benefits of Instant Payments?

Quantifying these benefits requires tracking key metrics, including:

Customer satisfaction scores to gauge the impact on retention and loyalty.

Transaction volume growth as instant payments become the preferred method.

Revenue improvements from reduced payment processing costs and new use cases.

Financial inclusion metrics, such as the number of underbanked individuals gaining access to financial services.

By regularly evaluating these indicators, businesses and financial institutions can measure their progress and adjust strategies to maximize the potential of instant payments.

The benefits of instant payments don’t just stop at faster transactions. They pave the way for innovation, customer loyalty, and financial inclusion. Over time, the advantages grow, reshaping the financial landscape and opening doors to new opportunities.